Snowflake’s (NYSE:SNOW) first quarter results were disappointing, and forward guidance even worse, causing a negative share price reaction. Much of the price move has since been reversed, but Snowflake’s near-term outlook is likely to remain fairly bleak. Consumption will improve when the macro environment recovers, which should cause growth to reaccelerate, but this may still be some way off.

Market

The demand environment remains soft, and this is being reflected in consumption patterns and below expectations growth. Management believes that enthusiasm for Snowflake remains high, but that customers are optimizing to control costs.

Snowflake’s older customers tend to be digitally native companies that have until recently been focused on growth at all costs. Newer customers are increasingly more mature organizations that have solid cost controls in place. Until recently this meant that newer cohorts were ramping more slowly. This has now changed as an increased focus on costs is leading consumption to grow more slowly amongst older customers.

While this type of performance will always raise questions about competition and underlying demand, it currently appears to be a macro issue. Amazon (AMZN) is a good proxy for Snowflake as they are a large percentage of overall deployments. Recent AWS growth has also been anemic and appears set to fall further.

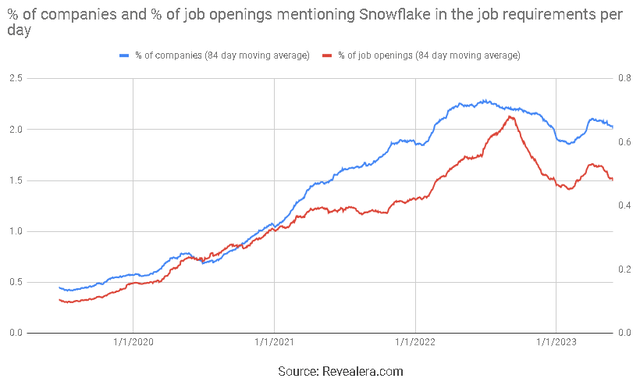

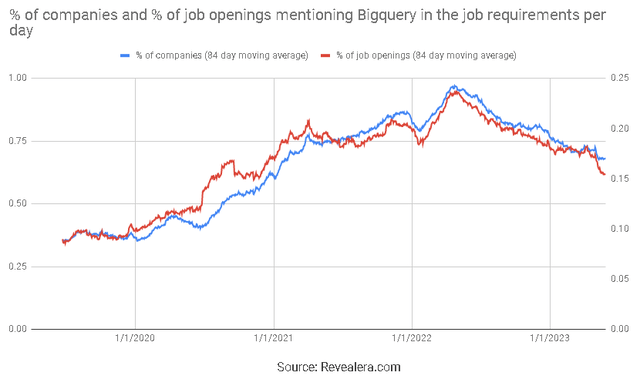

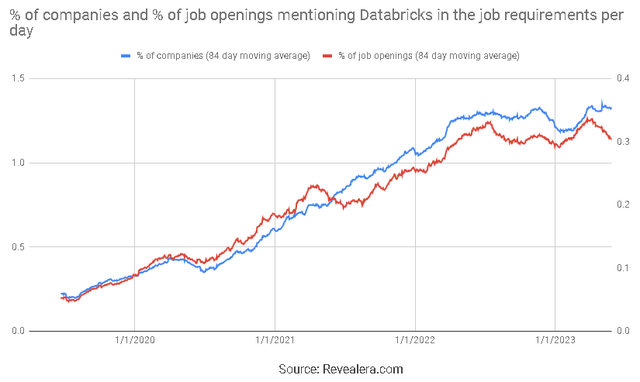

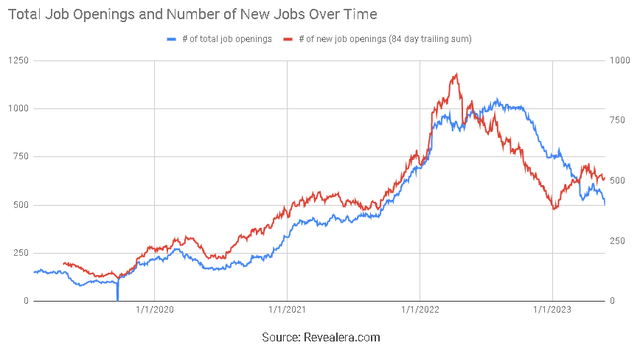

Snowflake has stated that Google (GOOG) BigQuery is its largest competitor, with Microsoft (MSFT) and Databricks also strong competitors. Job openings mentioning Snowflake in the job requirements have fallen over the past year, although not to the extent of job openings mentioning BigQuery. Job openings mentioning Databricks in the job requirements have been fairly flat over the same period, which could reflect greater demand for Databricks’ primary use cases.

Figure 1: Job Openings Mentioning Snowflake in the Job Requirements (source: Revealera.com) Figure 2: Job Openings Mentioning BigQuery in the Job Requirements (source: Revealera.com) Figure 3: Job Openings Mentioning Databricks in the Job Requirements (source: Revealera.com)

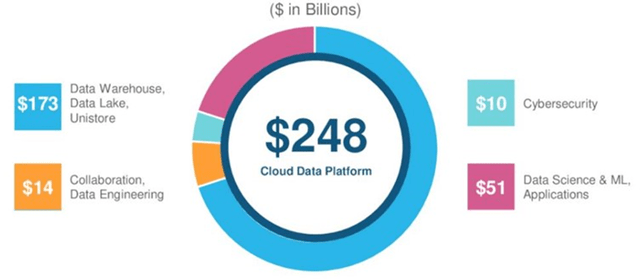

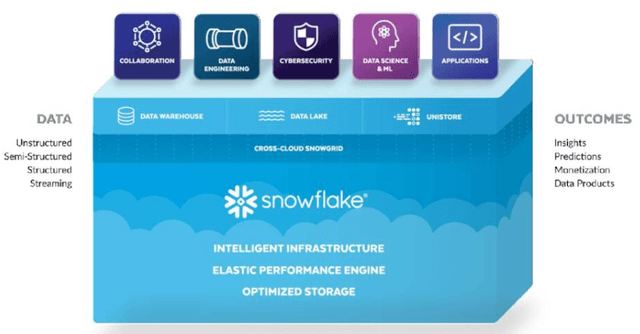

Given that the Snowflake story is still intact, expansion of the platform, and in turn the addressable market, remain important to the value of the company. Most of the addressable market lies within Snowflake’s core use case, but is still unclear how much adoption the product will achieve outside of OLAP. Snowflake is gaining traction within cybersecurity and collaboration could be important.

Figure 4: Snowflake’s TAM by Workload (source: Snowflake)

Snowflake

Snowflake provides a data warehouse for analytics use cases, but this is rapidly changing as the company introduces new features. Snowflake also wants to become an application platform and capture more machine learning workloads. The company also continues to introduce functionality targeted at specific verticals.

Snowflake has a number important products that are moving towards wider release, which should be supportive of growth, including Streamlit and Applica. Unistore and Snowpark could also help Snowflake to address new use cases.

Figure 5: Snowflake’s Platform (source: Snowflake)

Manufacturing Data Cloud

Snowflake launched the Manufacturing Data Cloud during the first quarter, which is focused on supply chain management. Management believes that supply chain management suffers from a data siloing problem which Snowflake can help address.

The Manufacturing Data Cloud aims to act as an operational hub for large enterprises, which could lead to strong network effects over time if Snowflake can gain sufficient traction. Blue Yonder has already announced that they will fully re-platform onto Snowflake. Blue Yonder is one of the largest software companies in supply chain management

Neeva

Snowflake recently announced that it intends to acquire the search company Neeva. Neeva has approximately 40 employees and has been working on generative AI powered search. The stated reason for the acquisition is to enable users and application developers to build rich search and conversational experiences. Neeva will also help enable non-technical users to utilize Snowflake.

The popularity of ChatGPT has brought more attention to the space, but there are issues that must be addressed to provide a viable enterprise search product. Neeva combines LLMs with traditional search approaches and is able to do attributional results. This is important in an enterprise setting where precise results are important.

AI

While Snowflake’s core product is an analytics database, the company isn’t really that well positioned to benefit from AI in the near term. The company is trying to position itself so that it benefits from increased AI activity though. Customers are reportedly already using Snowflake for training and Unistore enables low latency read and write, which should help Snowflake address inference use cases.

Snowflake is introducing ML-powered SQL extensions for analysts that will address use cases like anomaly detection and time series forecasting. This will allow SQL proficient users to leverage ML without needing to master the underlying data science.

Snowflake’s Snowpark programmability platform is targeted at data scientists and engineers. Snowflake plans on introducing a PyTorch data loader and an MLFlow plugin to help manage the lifecycle and operations of machine learning.

Data science, machine learning and AI use cases on Snowflake are increasing. Over 1,500 customers leveraged Snowflake for one of these workloads in the first quarter, a 91% YoY.

Snowpark

Snowflake believes it can benefit from AI/ML by allowing workloads to run close to the data in a secure fashion. Snowpark is the programmability platform for Snowflake and takes the platform more in the direction of Databricks. Data typically comes into Snowflake through data engineering processes that leverage Spark. Snowflake wants these workloads to run in Snowpark as it should be faster, less expensive and simpler. Snowflake has also introduced Snowpark Warehouses, which is a type of cluster that has more resources.

This potentially positions Snowflake to capture more workloads related to machine learning, but how the product will be adopted by the market remains unknown. Snowflake is pleased with current Snowpark consumption trends, with consumption increasing 70% QoQ. More than 800 customers engaged with Snowpark for the first time in Q1 and roughly 30% of customers are using Snowpark on at least a weekly basis, up from 20% in the previous quarter.

Applica

Applica is a company that Snowflake acquired in 2022, which has an AI platform for document understanding (helps customers to pull data from unstructured documents). This is unlikely to be as important as some of Snowflake’s other product introductions but should help to bring data onto the platform.

Streamlit

Streamlit is a framework for data scientists to create applications and experiences for AI and ML. Over 1,500 LLM-powered Streamlit apps have already been built. For example, GPT Lab offers pre-trained AI assistance that can be shared across users.

Unistore

Unistore is an important introduction for Snowflake as it allows the company to address use cases that otherwise would not be suitable for an OLAP database. Unistore utilizes what Snowflake refers to as a hybrid table, which features a storage system optimized for analytics and a storage system optimized for fast reads and writes. Snowflake can do this because the cloud allows it to present a unified experience to customers, even though data is stored differently behind the scenes. Unistore can be used in application stacks, machine learning pipelines or machine learning inference.

Data Sharing

Data sharing remains an important part of Snowflake’s long-term strategy and is growing steadily, although isn’t an important driver of financial performance yet. Snowflake enables customers to share data through its security and governance capabilities, including its data clean room technology. This allows customers to “share” data without actually having to reveal it. If these efforts reach critical mass it is likely to result in strong networks effects, particularly in areas like digital advertising, supply chain management and finance.

Figure 6: Snowflake Marketplace Performance (source: Snowflake)

Financial Analysis

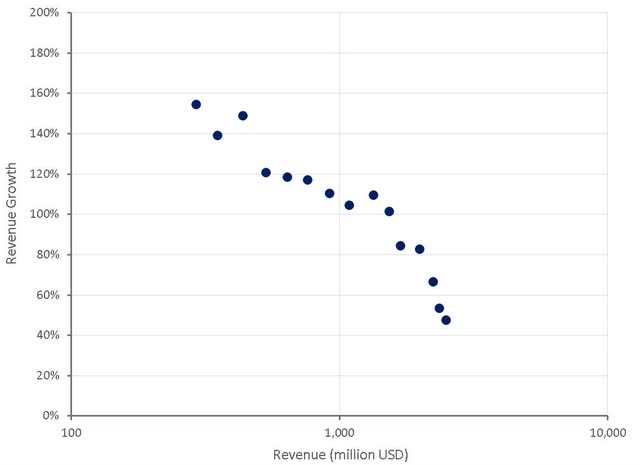

Revenue growth is expected to be around 34% YoY in the second quarter and for the full financial year. While optimization headwinds will ease at some point, and Snowflake has new products entering the market, if growth does not stabilize like management expects, SNOW stock will likely fall further.

There is considerable uncertainty with this projection though, both to the upside and downside. Snowflake forecasts based on the past four weeks of consumption data and there was no material consumption growth in April. This implies that there is no material consumption growth included in the guidance.

Figure 7: Snowflake Revenue Growth (source: Created by author using data from Snowflake)

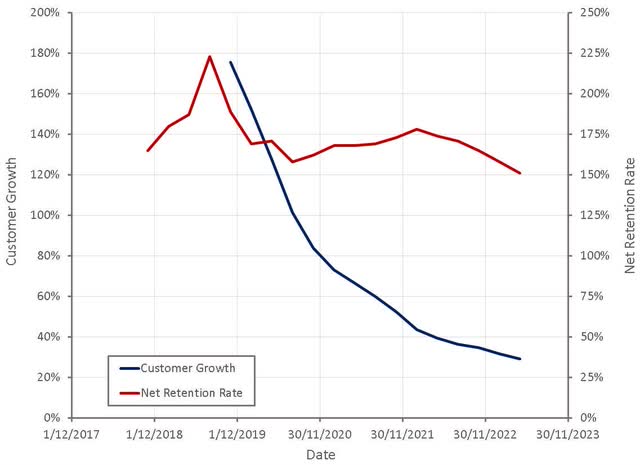

Snowflake’s net revenue retention rate continues to decline, although is still relatively high. The importance of this metric is often vastly overestimated, as it can reflect product and pricing differences as much as business performance. For example, Snowflake has stated that Global 2000 customers generally sign up at a little over 100,000 USD ARR before scaling 1 million USD over a 2-3 year period. This represents tremendous expansion off a fairly small base as Snowflake is rolled out within an organization. A seat based product may land at over 1 million USD and expand slowly as more seats are added, but that does not necessarily make it inferior.

Consumption was strong in February and March, before softening in April. Healthcare and manufacturing were areas of strength, while financial services outperformed expectations. SMB customers and the APJ region were areas of weakness.

Much of Snowflake’s consumption issues appear to be related to larger customers trying to control costs. Some organizations are retaining data for a shorter period of time and deleting data that is less valuable, which lowers both storage and compute costs. Snowflake expects this trend to continue, although is hopeful that improved price performance will ultimately stimulate demand.

Optimization can come from:

- Cloud vendors – improved hardware

- Snowflake – software improvements

- Customers – data retention, query frequency, etc.

Snowflake estimate that improvements made by itself and the cloud vendors result in roughly a 5% revenue headwind annually. For example, the number of queries increased 57% YoY in the quarter compared to 48% revenue growth. All of Snowflake’s customers have now been migrated to AWS Graviton 2, which is where the bulk of the company’s revenue is.

Figure 8: Snowflake Customers (source: Created by author using data from Snowflake)

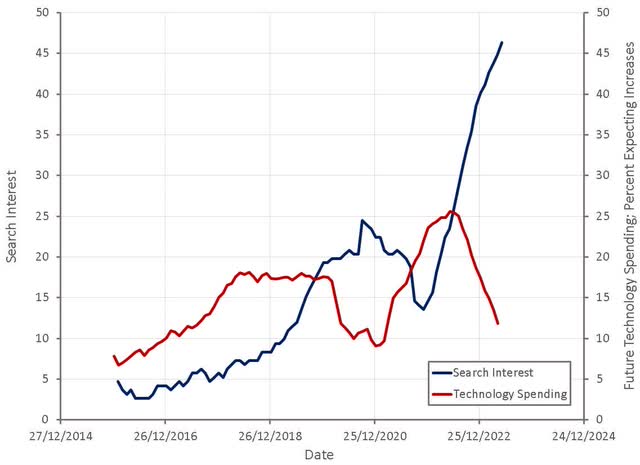

Search interest for “Snowflake Pricing” continues to be high, which could be indicative of demand or pricing pressure. Given that spikes in search interest align with reduced plans to invest in technology, it would appear to primarily be related to pricing pressure. This could indicate that customer optimization efforts will be ongoing, although May’s data indicates lower search volumes than April.

Figure 9: “Snowflake Pricing” Search Interest (source: Created by author using data from Google Trends and The Federal Reserve)

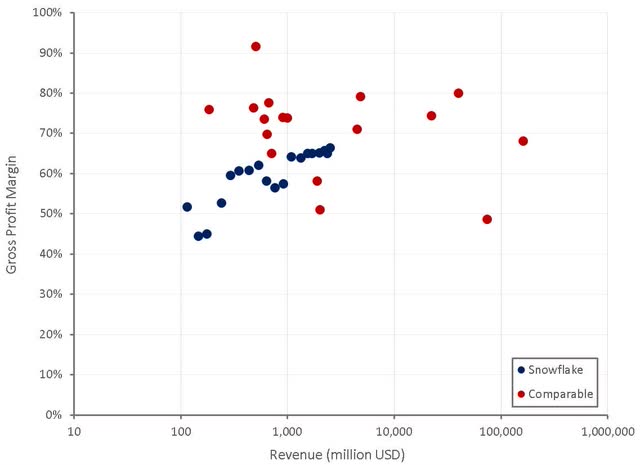

Snowflake’s gross profit margins continue to improve due to:

- Cloud agreement pricing

- Scale

- Product improvements

- Enterprise customer success

These trends are also expected to continue driving better gross profit margins going forward.

Figure 10: Snowflake Gross Profit Margin (source: Created by author using data from company reports)

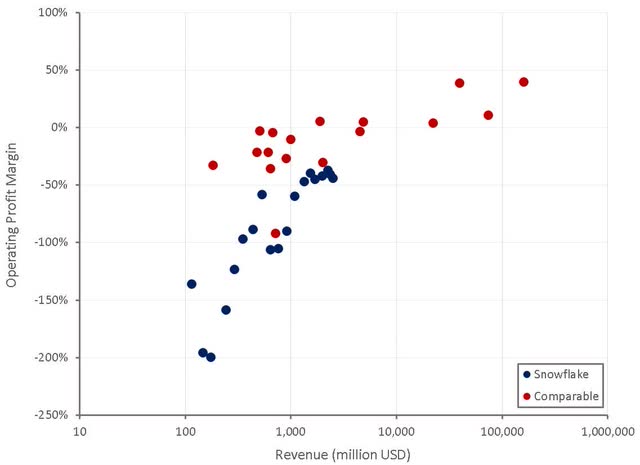

Operating profit margins are also expected to continue improving on the back of:

- Revenue growth

- Economies of scale

- Larger customer relationships

- Larger renewal mix leading to lower commissions

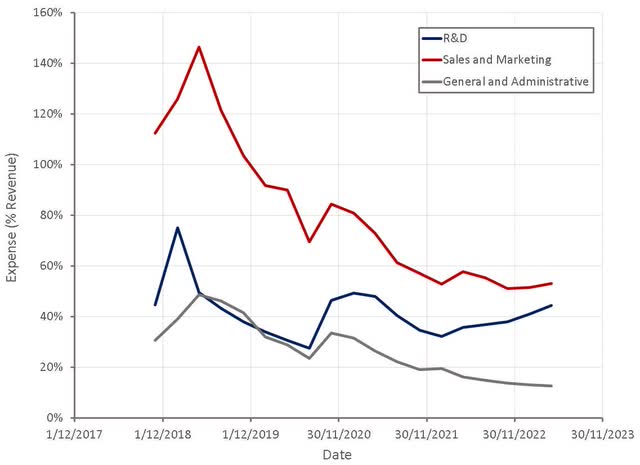

Snowflake’s losses are in large part due to stock-based compensation, with current SBC expenses around 40% of revenue. This should normalize eventually, but in the meantime is causing material dilution.

Figure 11: Snowflake Operating Profit Margin (source: Created by author using data from company reports) Figure 12: Snowflake Operating Expenses (source: Created by author using data from Snowflake)

Snowflake has slowed its hiring plans for this year and expects to add around 1,000 employees in FY2024, including M&A. The company is prioritizing hiring in product and engineering and only backfilling positions in the sales organization at the moment.

Figure 13: Snowflake Job Openings (source: Revealera.com)

Valuation

Snowflake has approximately 5 billion USD in cash, cash equivalent and short-term and long-term investments. The company has repurchased 1.4 million shares at an average price of 136 USD and plans on opportunistically repurchasing more shares using free cash flow.

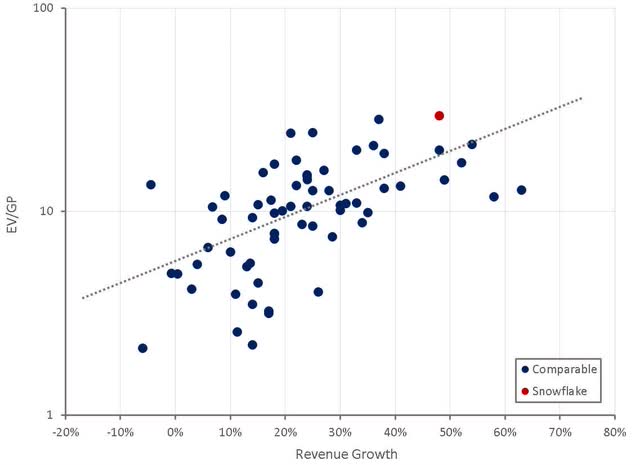

Snowflake continues to command a premium valuation based on its growth at scale, efficiency and business strategy. Given Snowflake’s first quarter results and forward guidance, it is somewhat surprising the stock price has not fallen further though. In the near-term Snowflake’s stock price is likely to be driven by investor sentiment toward AI. Looking forward, customer optimization efforts and its impact on growth will be more important.

Figure 14: Snowflake Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here