Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on May 15th, 2023.

Gladstone Land (NASDAQ:LAND) recently reported its Q1 numbers. The funds from operations or FFO came in as expected, and revenue missed consensus but grew year-over-year at 6.3%. Farms owned increased by five to a total of 169, but it has been a difficult environment, which was noted by management. Of course, that difficult environment directly results from higher interest rates, making it harder to find deals that make sense.

Overall, I believe that LAND looks like a reasonable value and could be considered an attractive investment today.

Tenant Issues

The earnings overall weren’t great, but they weren’t too terrible either, in my opinion. They have some tenants that they are having issues with, which caused some discomfort, but these are being dealt with and are a minority of their portfolio.

Two of the issues should be dealt with fairly soon, as they noted in their latest earnings call. One of the farms they had to take possession of outright and hire a third party to manage the farm (adding expenses.) The occupancy rate was held at 100%, seemingly because the property is still productive.

We had to remove that one tenant during the quarter and stepped in to temporarily operate the farm. But this time we did it many years ago, this time we did it with a third-party management group that does manage farming operations. We end discussions with that new group to lease this farm and we hope we have a lease executed on this farm before the end of the second quarter.

Two other farm tenants are slow to pay.

In addition, we have two slow paying tenants, these are not the kind of trouble that we’ve got with that one, that I’ve just mentioned. Two slow paying tenants are partly due to excess supply in the market, so the crops they have in these areas as most of you may know, there’s a huge surplus of almonds in. If you would please, please buy some almonds today and get the prices back up.

They also noted that one of these slow-to-pay tenants has been “more challenging” and that they had to get lawyers involved. Which, of course, means more added expenses and a longer time to resolve the issue.

The Valuation Is Attractive

There are a few different ways to look at the valuation of a REIT.

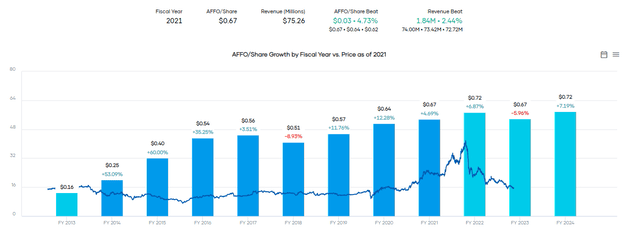

One of the more common ways to value them is with the P/AFFO, similar to P/E. FFO is the standard measurement for REITs, and then they provide an adjusted FFO or AFFO. The latest AFFO was $0.17 in the last quarter.

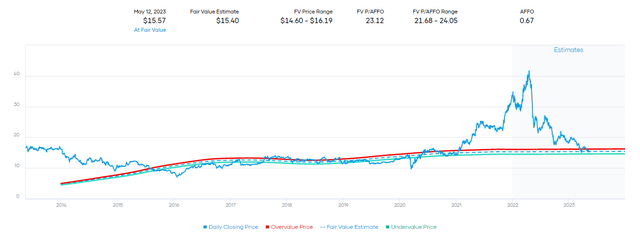

In this case, historical valuation shows us that, on average, shares of LAND have traded around 21 and 24x. We can also see how insane the 2021 and 2022 valuation was starting to get. Currently, the forward P/AFFO is at 23.12x, according to Portfolio Visualizer.

LAND AFFO Fair Value Estimate (Portfolio Insight)

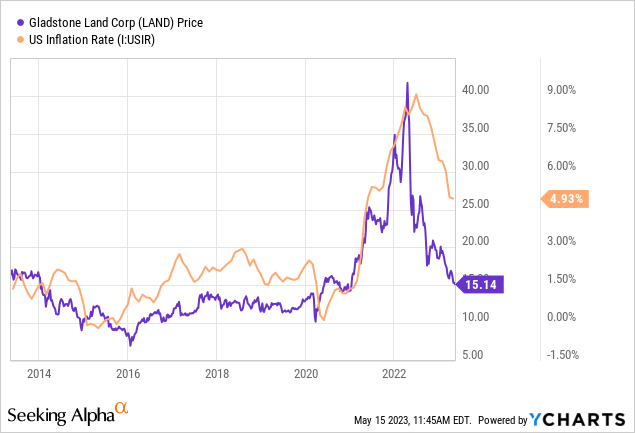

There was a high correlation in the price action of LAND linked with inflation in the U.S. Which can help explain some of the absurdity in the price action we saw in the previous years.

Ycharts

The forward P/AFFO is based on the expectation of $0.67 in AFFO for this year. That’s a small decrease from the prior year when they reported $0.72 in AFFO.

LAND AFFO (Portfolio Insight)

Therefore, based on the historical P/AFFO range, picking up LAND shares at $15.40 could be generally attractive.

Growth going forward is something to consider. With rising interest rates, the financing costs become prohibitive if they can’t charge more for rent. Should the Fed cut rates, that could put them back in a better position, but the exact timing of that is not certain. It could be next month, or it could be in five years. It all depends on how the data plays out with inflation and economic conditions overall. This was really echoed by the remarks of David Gladstone in the call.

I give it 50:50 chance that we’ll find another way of doing the same deals we did before, I mean obviously they won’t be lending at 3.5%. But they may be lending at 5% or 4.5% and we can make those numbers work in certain products and certain things that are going on out there in the field. And so we’re very optimistic at this point that it’s going to turn soon and I don’t know, it’s really one of those things that everybody in the business is contemplating of what’s going to happen in the next six months. So yes, we’re probably bound by interest rate increases, although they’re going down now. So who knows where they’ll go?

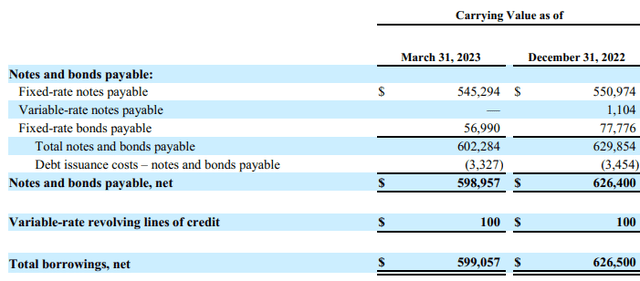

Fortunately, they have nearly 100% of their borrowings based on fixed rates. So while borrowing costs are rising, what they currently have outstanding isn’t being impacted hardly at all. Here’s the breakdown as of the end of the first quarter.

LAND Debt (LAND Quarterly Report)

This is as well as the fixed rate preferred they had issued. Two of these are publicly traded, the 6% Series B (LANDO) and 5% Series D (LANDM). There is also the 6% Series C that they have issued, and they’ve applied to seek listing on the Nasdaq.

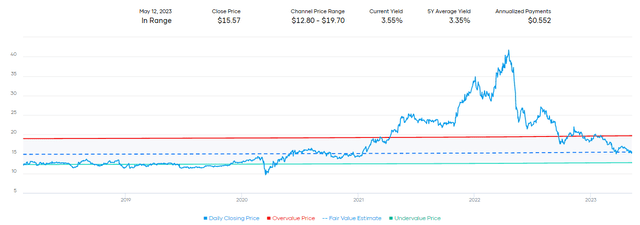

Another way to value a REIT is by looking at the dividend yield historically. We see a similar trend here where 2021 and 2022 were quite absurd. The current yield is a touch above the 5-year average yield. LAND isn’t necessarily something that you would call a high-yield play. It’s definitely on the lower end in terms of providing yield. That can make it less competitive than U.S. Treasuries at this time, which I believe is something that can play a role in discounting LAND’s current price.

LAND Yield Fair Value Estimate (Portfolio Insight)

On the other hand, LAND has boasted that they’ve also been able to grow their monthly dividend. That’s something that buying a Treasury won’t do. Albeit, these are quite small bumps in the dividend, fractions of a cent. Year-over-year, the latest dividend declared would have been a 1.32% increase. However, the increases have been quite consistent.

Finally, moving on to our common distributions. We recently raised our common dividend again to $0.046 per share per month. This marks the 30th time we’ve raised our common dividend over the past 33 quarters resulting in an overall increase of over 53% over that period.

Notably, the $0.67 in AFFO expected for this year still covers the annualized dividend of $0.552. That leaves them with plenty of room to keep the dividend where it is and even potentially continue on with its quarterly increases.

Finally, one other way we can take a look at the valuation of a REIT is a net asset value per share or NAV. In this case, LAND provides the NAV, and that saw a large bump in the latest quarter due to 34 farms receiving updated valuations done by a third party. This saw the NAV per share increase from $15.54 to $17.12. An increase of $1.58, which puts the current trading price at a deep discount.

Playing It With Puts

I previously owned a position in LAND due to their unique exposure to farmland, which is generally considered valuable for humans to survive. This is one of only a couple of publicly traded ways to really get exposure to this space. Farmland Partners (FPI) is its main competitor and is often mentioned alongside LAND.

I ended up exiting my position in LAND when it went to some absurd levels in 2021. In hindsight, I certainly missed the top as it pushed around the $40s, but I also missed the slide down to the current trading level too. I discussed that in more detail previously.

Anyway, my main takeaway is that I believe LAND is now a cheap and viable investment option again for the reasons outlined above, even with the potential headwinds. That’s why I recently shared writing some puts on shares of LAND at a $15 strike price. This was basically selling them at-the-money as shares dropped to near this level after their earnings; I collected $0.60 by selling puts, which would take the breakeven down to $14.40.

This was particularly noteworthy because, as I highlighted in the trade alert post, it represents a lower cost basis than when I previously owned a batch of shares. This is a fairly aggressive strategy for potentially entering a position, as the chance for assignment is high. Alternatively, it’s a great way to potentially lower the breakeven by taking some premium upfront. The premium actually works out to more than a year’s worth of the actual dividend from LAND itself.

Conclusion

LAND might not usually be the most exciting REIT to invest in, but that’s part of its charm. Although the 2021/2022 price action certainly was ‘exciting,’ that certainly appeared to be more of an anomaly based on its historical trading. With valuations returning to reality today, I believe it presents an attractive time to consider getting into this name again for the long term.

Read the full article here