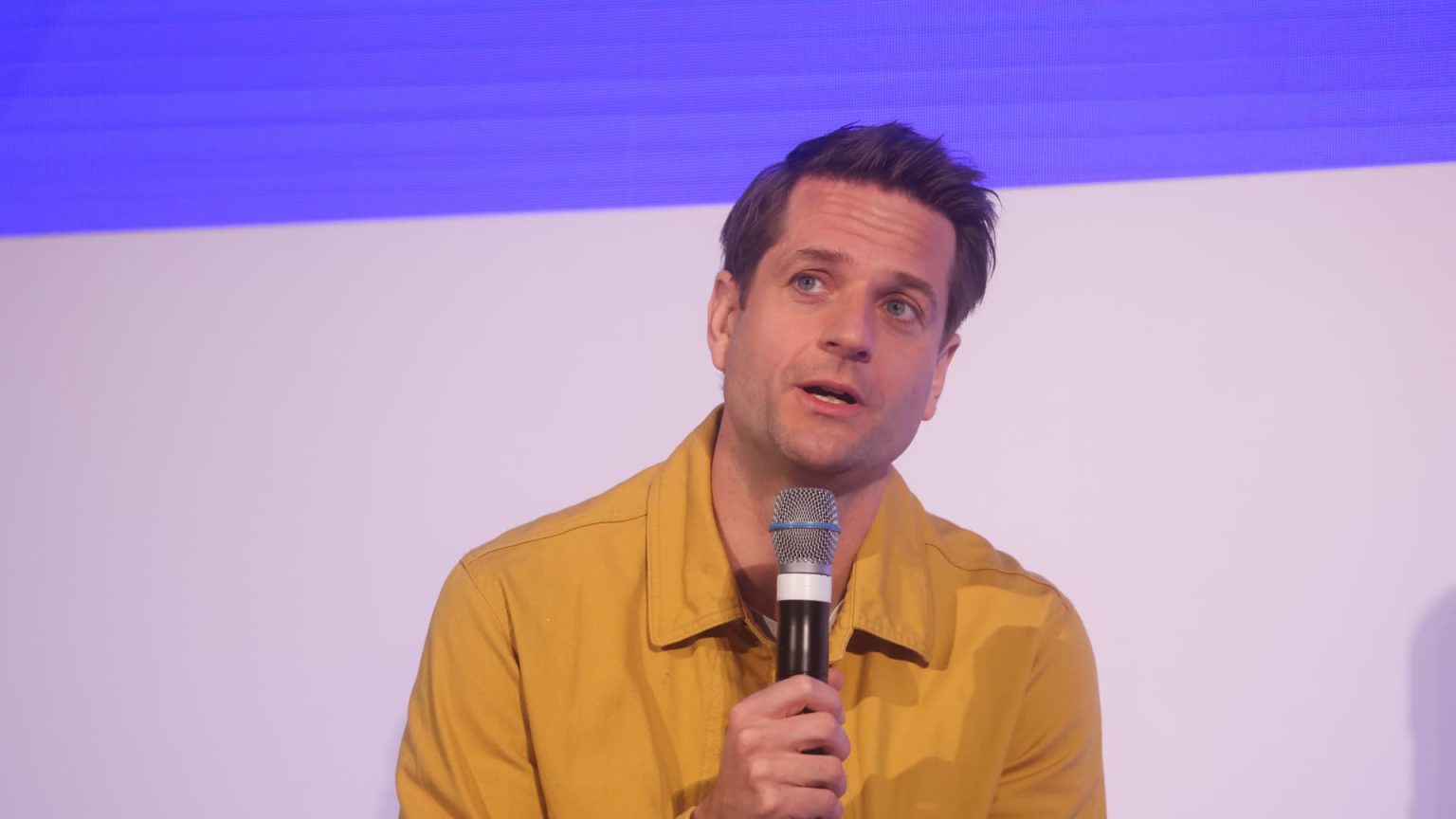

Sebastian Siemiatkowski, CEO of Klarna, speaking at a fintech event in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg via Getty Images

Klarna, the Swedish buy now, pay later fintech company, halved its net loss in the first quarter, recording a significant improvement in its bottom line after a major cost-cutting drive.

The company posted a net loss of 1.3 billion Swedish krona ($120.7 million), down 50% from the 2.6 billion krona loss in the same period a year ago.

Klarna reported total net operating income of 5 billion Swedish krona, up 22% year-over-year.

“This quarter we’ve impressively managed to grow GMV and revenue, at the same time as we cut costs and credit losses, and also investing ambitiously in AI driven products,” Klarna CEO Sebastian Siemiatkowski said in a statement.

“We are on track to achieve profitability this year all while revolutionizing shopping and payments through our AI-powered approach.”

Siemiatkowski previously told CNBC the company was planning to achieve profitability in the second half of 2023.

Klarna attributed the latest reduction in losses to a fall in customer defaults thanks to an improvement in its underwriting, as well as to diversification into other sources of revenue, such as marketing.

The results show how Klarna is making “significant strides” toward profitability on a monthly basis, the firm said.

Klarna, which now has more than 150 million customers, was in April given a credit rating of BBB/A-3 with a stable outlook by S&P Global. The ratings agency at the time said this reflected Klarna’s “ability to defend its robust e-commerce position in its key markets, rebuild profitability,” and “maintain a strong capital buffer.”

Early indications signal that Klarna’s deep cost-cutting measures are starting to pay off. The company went on a hiring spree during 2020 and 2021 to capitalize on growth triggered by the Covid-19 pandemic, and was forced to reduce headcount by roughly 10% in May 2022 in response to investor pressure to slim down operations. Despite this measure, it still later lost 85% of its market value in a funding round last summer.

Klarna is not alone in its troubles. Buy now, pay later firms, which allow shoppers to defer payments to a later date or pay over installments, have been particularly impacted by souring investor sentiment on technology, amid a worsening macroeconomic environment.

AI push

More recently, Klarna has turned its focus toward AI. The company revamped its app with a more advanced AI recommendation algorithm to help its merchants target customers more effectively.

Klarna previously launched the ability to integrate OpenAI’s ChatGPT into its service with a plugin that lets users ask the popular AI chatbot for shopping inspiration. The company said it was embedding AI in its business to “improve internal efficiencies and provide customers with an even better service and experience,” for example through real-time translations in customer chat.

The company has now also made a foray into facilitating short-term holiday rentals. Earlier this month, Klarna announced a partnership with Airbnb to let the online vacation rental firm’s customers book holidays and pay down the cost over installments.

Read the full article here