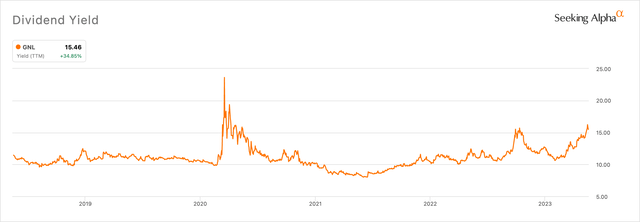

Global Net Lease (NYSE:GNL) last declared a quarterly cash dividend of $0.40 per share, in line with its prior payment and for a 15.5% forward yield. This yield has surged to new highs against common shares that are down by 19% since the start of the year. The operating conditions for REITs are bleak as a Feds funds rate hiked to highs not seen since the 2008 financial crisis has heavily disrupted balance sheets. This is as inflation remains far above the Fed’s 2% target and the March regional banking panic has not come to an end. Hence, it’s not hard to see why the current yield is at risk. Indeed, while not a purely office REIT, GNL’s 40% property portfolio allocation to offices has come at a cost against the current stock market zeitgeist. Investor confidence in the sector has entirely collapsed as WFH becomes a defining feature of the post-pandemic world of work.

Seeking Alpha

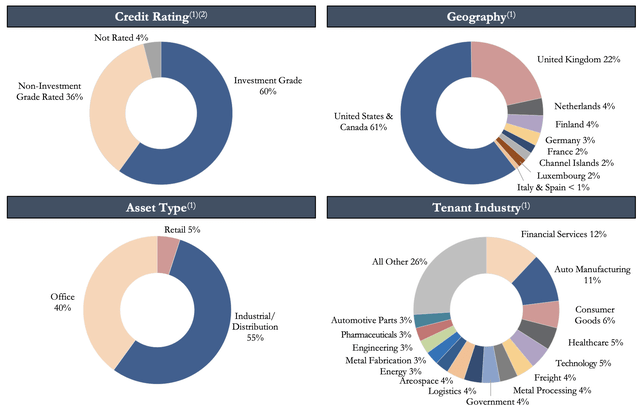

US commercial real estate is now the sick man of the economy and GNL’s 7.4x price to forward FFO multiple, a 40% discount to its peer group median, is meant to price in the risk of rising office occupancy and weaker rents. Bulls would be right to flag that the REIT’s extensive portfolio diversification helps to mitigate this risk. As of the end of its fiscal 2023 first quarter, GNL owned 317 properties spread across 39.6 million square feet and 140 tenants in 52 different industries.

qq

Office accounted for 40% of its property portfolio’s straight-line rent, down around 100 basis points from the prior fourth quarter. The US also accounted for 61% of its SLR. This was also down around 400 basis points from the prior quarter with the UK seeing its allocation increase to 22% from 16%. Critically, this slow shift away from office properties should help address long-term concerns by bears and could lead to a rerating in a future where the current bearish sentiment on offices still lingers.

GNL’s portfolio was 98% leased with a weighted average lease term of 7.8 years and with nearly 60% investment-grade tenants as of the end of the first quarter. The REIT executed lease renewals totaling 678,500 square feet during the quarter, this was a 4.2% spread over the old lease and should generate $6.8 million per year in net new annualized straight-line rent. Occupancy in the year-ago comp was around 70 basis points higher at 98.7% with a higher weighted average remaining lease term of 8.4 years.

A Payout Under Pressure As Interest Expenses Rise

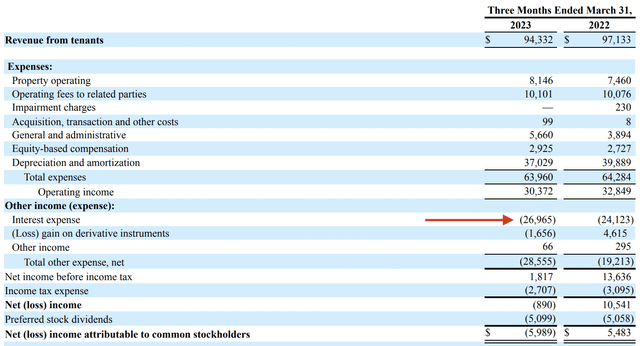

GNL reported fiscal 2023 first-quarter revenue of $94.3 million, a decline of 2.9% over the year-ago comp but a miss by $450,000 on consensus estimates. Interest expenses during the quarter were $26.96 million, only up by 11.8% over the year-ago comp due to the heavily fixed nature of its balance sheet debt. For some context, some REITs have seen year-over-year interest expenses jump by 50%. However, net income came in at a loss of around $6 million versus a profit of $5.5 million in the year-ago comp partially due to the impact of certain derivative instruments.

Global Net Lease

Net operating income was $86.2 million during the first quarter, down from $89.7 million in the year-ago period to drive adjusted funds from operations of $39.8 million. AFFO adds back unrealized losses on derivative instruments and also excludes certain other non-cash income expense items. AFFO per share at $0.38 beat consensus estimates by $0.02 but was a decline from $0.43 in the year-ago quarter.

How 2023 Could Play Out

The REIT is currently paying out around 105% of its AFFO as a quarterly distribution to its common shareholders. With AFFO in decline versus its year-ago comps, GNL could find the current payout ratio moving higher if the quarterly payout is maintained at its current level. This opens up the specter of a dividend cut in the near future as GNL also has to make payments to its preferred shareholders.

Global Net Lease

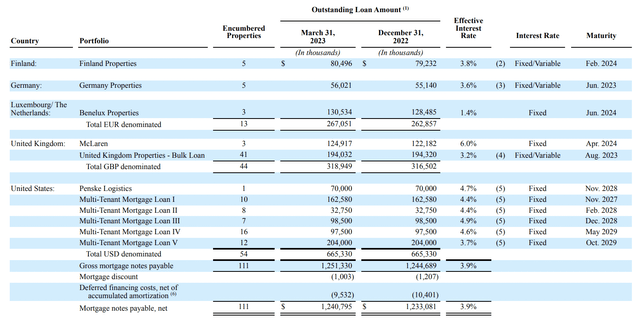

The externally managed REIT has a wall of debt maturities coming up. There is at least $250 million in principal payments left to pay in 2023 with another $335.9 million of payments to be made in 2024. This is against cash and equivalents of $119.2 million as of the end of the first quarter. A dividend cut is not entirely certain with management stating during the first-quarter earnings call that they have the ability to keep on paying it with “very little stress”. This might change if AFFO continues to decline and GNL’s currently high occupancy continues to trickle lower. The REIT refinancing its debt at higher rates will add further pressure on FFO. Hence, even with the discount to its peers, GNL stock is not a clear buy here due to the uncertainty around its dividend payout this year.

Read the full article here