Broadcom Inc. (NASDAQ:AVGO) designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

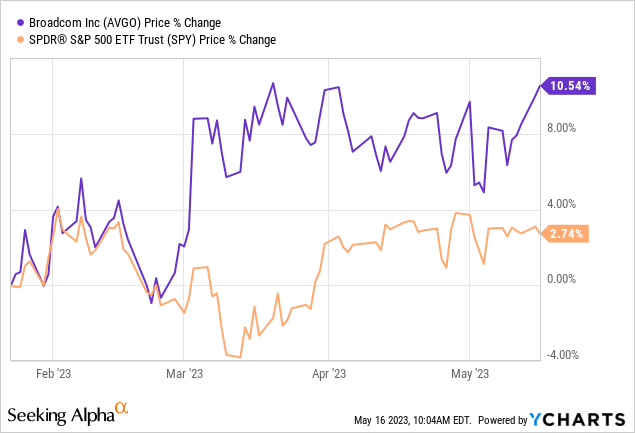

We have published an article about Broadcom on Seeking Alpha in January 2023, titled as: “The Pros And Cons Of Investing In Broadcom In 2023”. Back then, we have rated the stock as a “buy”, because in our opinion the pros have outweighed the cons. The pros were: strong liquidity position, safe and sustainable dividend and attractive valuation based on a set of traditional price multiples.

Since then, AVGO stock has gained more than 10%, outperforming the broader market.

Today, we will be looking at the firm from a profitability and efficiency point of view, and we will also address some of the cons that we elaborated on in our previous writing.

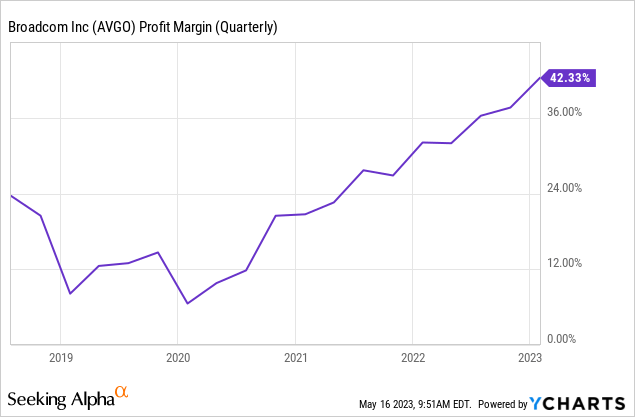

To start, we will be looking at the net profit margin first and its development over the past 5 years.

Net profit margin

Net profit margin is a widely used measure of profitability. The following chart depicts AVGO’s net profit margin over the past five years.

While the profitability has been declining in the period between 2018 – 2020, since 2020 it has improved substantially, from less than 10% to more than 40%. This development is definitely a good sign for investors, however we have to also understand what factors have been driving this improvement.

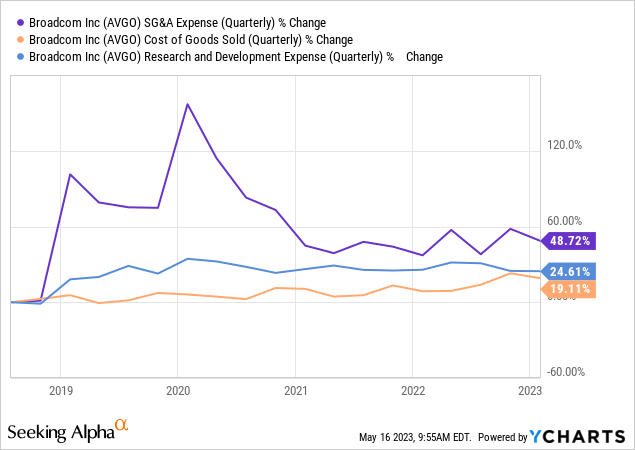

The following chart shows that during the past years, AVGO has managed to effectively control and manage its costs. The firm has not been hit by skyrocketing SG&A expenses or increasing COGS, which have hurt the margins of many companies in the not so distant past.

We believe that this performance demonstrates the management’s ability to effectively steer the company even in times of uncertainty and during periods of high inflation.

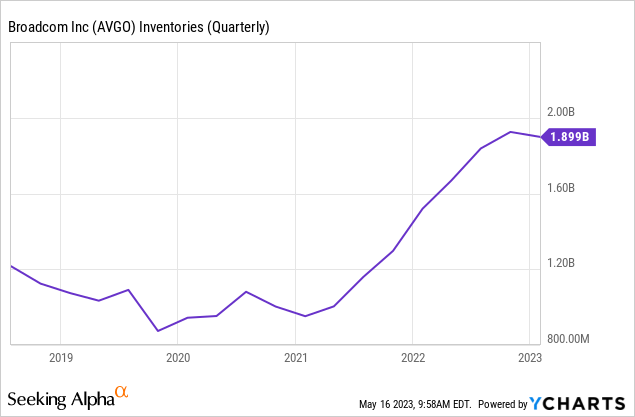

Looking forward, we have pointed out in our previous article that we are somewhat concerned about the rapid increase in inventory, which has outpaced sales growth in the past years. We mentioned that to reduce inventory, the firm may need to use discounting in the near future, which may in turn have a negative impact on the margins.

So far, it has not been the case. AVGO has managed to slightly reduce its inventory levels without hurting the net income margin, which is definitely another good sign. Regardless, we have to keep an eye out for this development in the coming quarters, to make sure that the profitability will not be hurt.

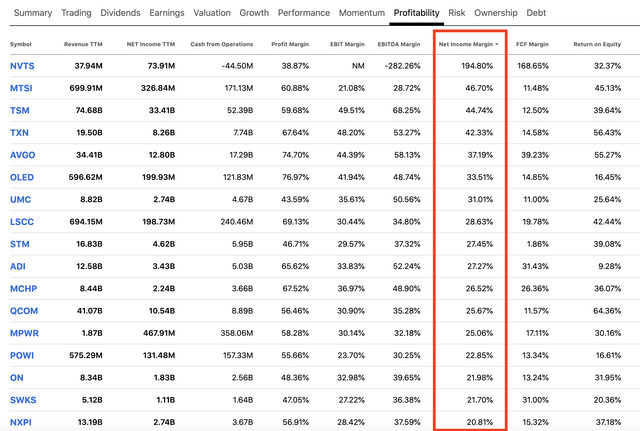

Last, but not least, comparing AVGO to its peers also shows that the firm’s profitability compares favourably with the profitability of its peers in the semiconductor industry.

Comparison (Seeking Alpha)

All in all, we believe that AVGO’s business is attractive from a profitability point of view.

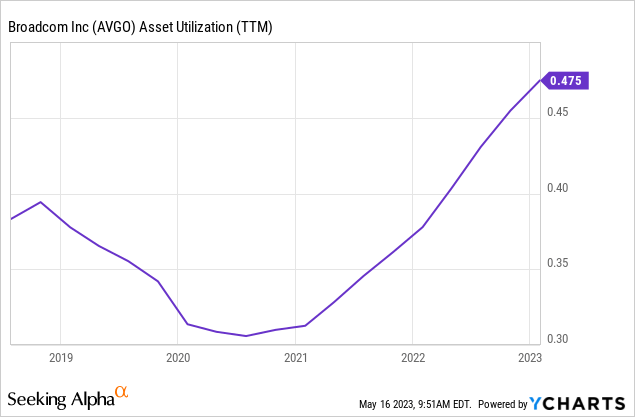

Asset turnover

Asset turnover or asset utilization is a measure of efficiency. It is defined as the ratio between sales and total assets. In general, we prefer to see stable or improving asset turnover over time.

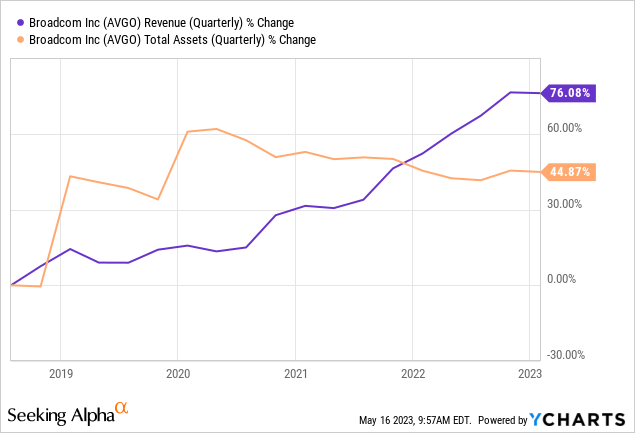

The chart below shows that AVGO’s efficiency has also been gradually improving since 2020.

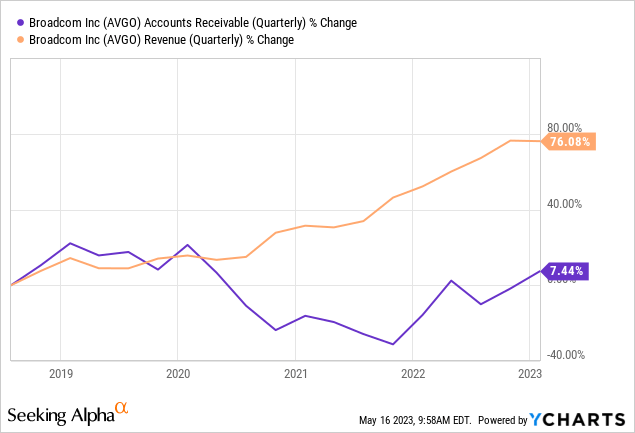

Sometimes firms can achieve such results by changing their revenue recognition practices in order to record higher sales and higher sales growth. Such practices can be detected by comparing the growth of revenue and accounts receivable. If the growth of accounts receivable is higher than the revenue growth, it can be a warning sign of manipulation. It is not the case, however, for AVGO. The firm’s revenue growth has substantially outperformed the growth in accounts receivable, which is another good sign for investors.

All in all, we believe that Broadcom’s business is also attractive from an efficiency point of view. Going forward, we expect the revenue growth to continue, as a result of improving consumer confidence and the potential positive impacts of the VMWare acquisition and the CHIPS act.

At this point we also have to mention that uncertainties with regards to the VMWare deal remain. The European Commission extended a final decision for the regulator to rule on the deal by three days until June 26.

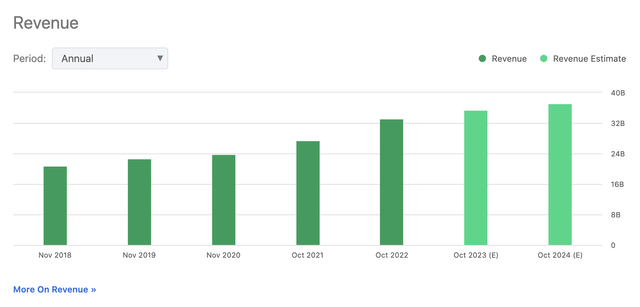

Analysts are also expecting the revenue growth to continue.

Revenue estimates (Seeking Alpha)

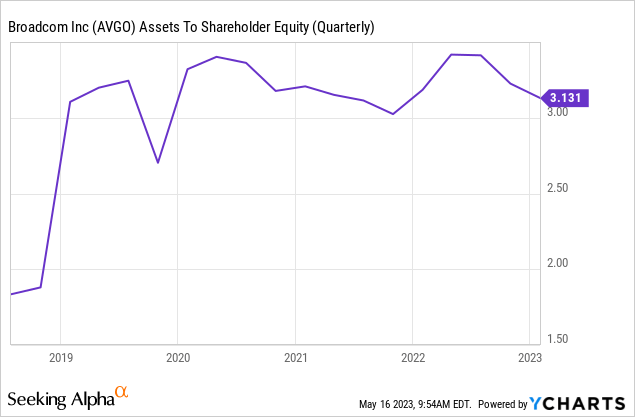

Equity multiplier

This measure indicates how much of the firm’s total assets are supported by equity or in other words, how much debt is being used. A ratio close to one indicates that there is little debt in the capital structure.

The following graph shows that since 2019, there has been no significant change in the capital structure. This also means that AVGO’s growth has not been fueled by extensive growth in leverage.

AVGO is also well-positioned from a liquidity point of view, with both the current- and the quick ratio being above 1.

All in all, we do not believe that AVGO is likely to have problems with its leverage in the near future, which could negative impact the company’s financial performance.

To sum up

Despite the challenging macroeconomic environment, AVGO has managed to improve both its profitability and efficiency. These improvements are reflected in the net profit margin and asset turnover figures.

The firm’s latest inventory figures are also showing that AVGO may be able to reduce the inventory levels, without hurting the margins significantly.

The improving macroeconomic environment, including the moderating inflation, and the firm’s effective cost controls make AVGO’s business attractive going forward.

For these reasons, we maintain our “buy” rating.

Read the full article here