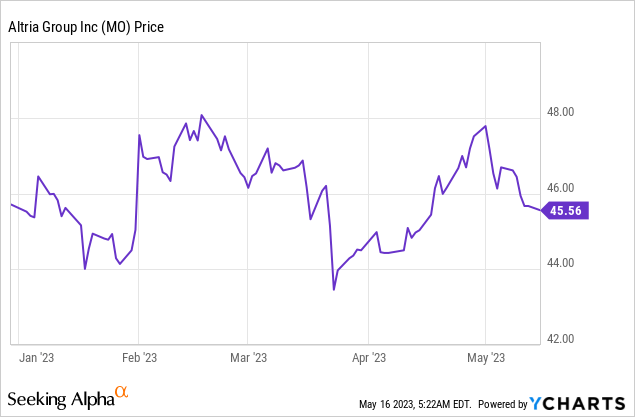

Cigarette maker Altria (NYSE:MO) reported mixed results for the first-quarter (EPS beat, revenue miss) in April. However, Altria reaffirmed its adjusted EPS guidance for FY 2023, which implies 3-6% year over year growth, and investors can look forward to receiving mid-single digit dividend growth going forward. At the same time, investors can expect Altria to buy back shares and build out its lower risk product portfolio, in part through the acquisition of e-vapor company NJOY. With shares continuing to sell at a low earnings multiplier, I believe Altria could be a part of a conservative investor’s dividend portfolio!

Macro headwinds and shifting product portfolio

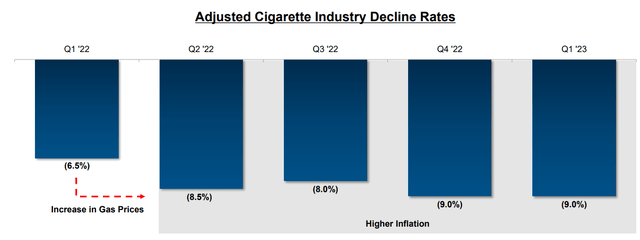

Altria continued to face headwinds in the macro environment in the first-quarter that weighed on cigarette shipments as well as revenues. Altria reported a top line decline of 2.9% for the first-quarter as inflation, chiefly, is a limiting factor for the company’s product sales. The adjusted cigarette industry decline rate, according to Altria, was 9.0% in the first-quarter… the same it was in the previous quarter. The biggest driver of the decline in industry volumes in the first-quarter, based on Altria’s factor analysis, was inflation yet again.

Source: Altria

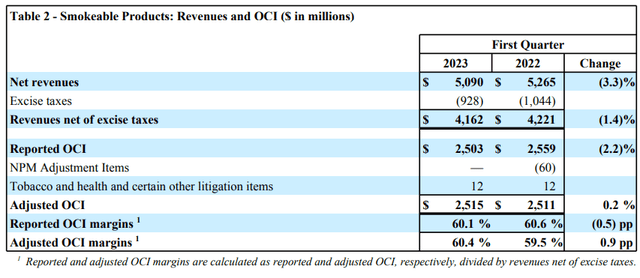

Altria’s smokeable segment continued to see moderate declines in the first-quarter: net revenues declined 3.3% year over year to $5.09B while the segment’s operating income fell 2.2% to $2.50B. Because of the challenged picture in traditional tobacco products, Altria is pivoting to alternative products, such as vape pods.

Source: Altria

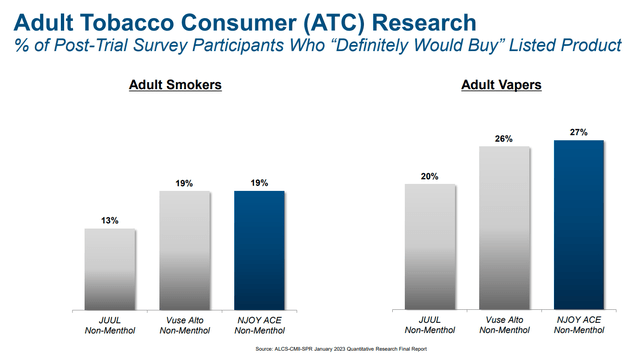

With inflation affecting cigarette volumes and sales, Altria is investing heavily into the expansion of its alternative product portfolio which is the key reason behind the acquisition of NJOY, a maker of e-cigarettes and pods. Vapes have become increasingly popular especially with younger consumers and Altria is expanding its product portfolio by moving away from traditional tobacco products. NJOY’s vape products are popular with the younger demographic and the acquisition opens up a new way for Altria to grow its alternative products category.

Source: Altria

Reaffirmed guidance for FY 2023

Altria reaffirmed is fully adjusted EPS guidance for FY 2023 and continues to expect $4.98 to $5.13 per-share in earnings, showing a year over year growth rate of 3-6%… if results are achieved as projected. In FY 2022, Altria generated EPS of $4.84 per-share which showed 5% year over year growth. Altria is currently paying a quarterly dividend of $0.94 per-share which I expect will rise to $0.96-0.98 per-share in the second half of the year.

Altria’s valuation

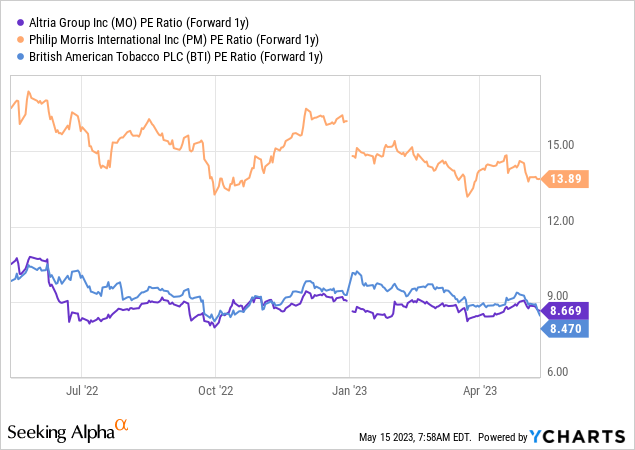

The thing that I like most about Altria is the attractive risk/reward relationship that results from a low P/E ratio and a high dividend yield. Altria has a P/E ratio of 8.7X based off of FY 2024 earnings which implies an attractive earnings yield of 11.5%. Philip Morris International (PM) and British American Tobacco (BTI) have P/E ratios of 13.9X and 8.5X. Besides Altria, I also like British American Tobacco due to the company’s strength in the vape market (BTI owns the Vuse brand) and aggressive growth plan regarding alternative product categories (vape, heated tobacco products and nicotine pouches).

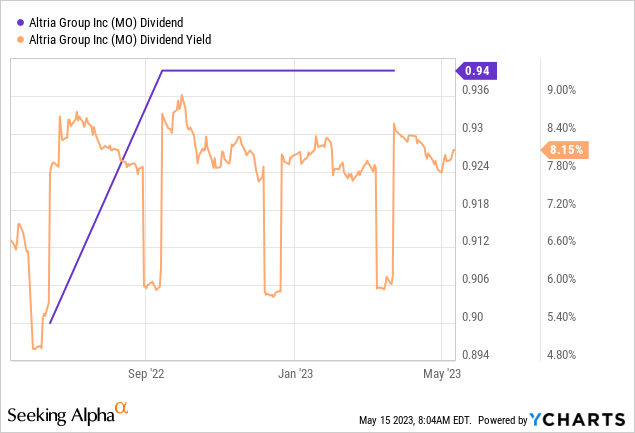

Dividend yield exceeding 8%

For me, Altria is chiefly a dividend investment as the cigarette company is currently paying $3.76 per-share in dividends each year… which calculates to an 8.2% dividend yield. Based off of Altria’s adjusted earnings guidance ($5.06 per-share at the mid-point), I estimate that the cigarette company will pay out an estimated 75-76% of its expected adjusted earnings in FY 2023. I calculate the payout ratio assuming a $0.02-0.04 per-share quarterly dividend increase in the second half of FY 2022.

The dividend should therefore be quite safe and the payout ratio leaves room for a dividend increase which Altria typically announces at the end of August. According to Altria’s Investor Day presentation from March (Source), Altria targets mid-single digit revenue growth going forward.

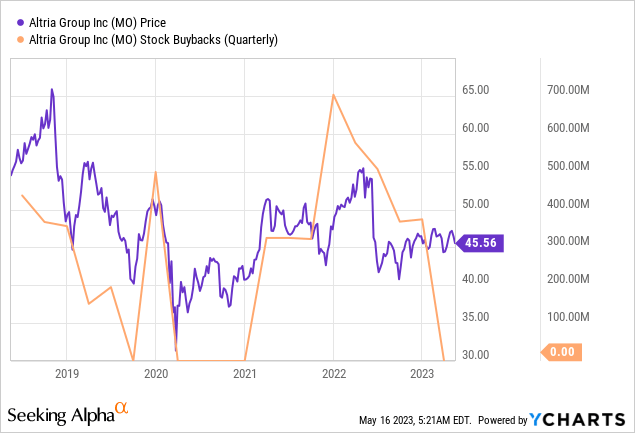

Stock buybacks may provide additional support

Altria has $1.0B remaining in its stock buyback authorization. Due to the acquisition of e-vapor maker NJOY in the first-quarter, Altria did not buy back any shares during the quarter. Over time, however, Altria has regularly bought back stock and I would expect the tobacco company to resume buying back stock again in the second-quarter.

Risks with Altria

The two biggest risks for Altria are the long term decline in the share of smokers, which is leading to a reduced market size in the traditional tobacco market, and government regulation. As to the second point, Altria wrote down the value of its investment in JUUL Labs chiefly because of government regulation. A ban of vape product could be another major regulatory challenge for Altria’s business. What would change my mind on Altria is if the tobacco firm saw slowing dividend growth or deteriorating dividend coverage based off of its adjusted earnings.

Final thoughts

I believe Altria has a role to play in a conservative investor’s dividend portfolio due to the firm’s guidance that it will grow its dividend at mid-single digit rates going forward. I believe investors can expect an adjusted EPS payout ratio of approximately 75-76% in FY 2023 and the tobacco firm has $1.0B remaining in its stock buyback authorization. Altria’s share price has dropped 5% since the beginning of May and I believe the drop represents another engagement opportunity for dividend investors that look to add a high-quality 8% yield to their portfolios!

Read the full article here