Meta (META), the parent company behind Facebook, has famously referred to 2023 as the “year of efficiency.” Companies across Silicon Valley and beyond are taking the current recession as an opportunity to evaluate their cost structures, evaluate what headcount and projects are truly necessary to drive growth, and make cuts accordingly.

Sprout Social (NASDAQ:SPT), a software company that specializes in developing management tools for social media marketing managers, is a victim of the current macro environment. The once fast-growing software startup has seen relentless revenue deceleration, which is calling into question its premium valuation multiples. Since the start of the year, Sprout Social has tumbled by nearly ~30%, while losses accelerated following a recent disappointing Q1 earnings print.

Though I was a former Sprout Social bull, I have turned cautious since the start of the year. After parsing through the company’s latest results, I remain neutral on Sprout Social and am more content staying on the sidelines.

Here’s the problem with Sprout Social at the moment: the company is completely reliant on its clients’ propensity to spend on social media. Right now, companies are slashing advertising and marketing budgets across the board to rein in profitability, across all media – including and especially digital spending. And with less advertising activity to go around, that means the people whose sole job it is to manage online content (in other words, the primary users of Sprout Social’s software) are also at risk of being axed.

We can see the impacts of this trend playing out quite easily in Sprout Social’s results, which display consistent deceleration in revenue growth alongside far slower customer growth (especially as smaller and frailer clients churn).

Moreover – Sprout Social still remains quite an expensive stock, even after its recent slide. At current share prices near $42, Sprout Social trades at a market cap of $2.30 billion. After we net off the $187.2 million of cash off Sprout Social’s most recent balance sheet, the company’s resulting enterprise value is $2.11 billion.

For the current fiscal year, meanwhile, Sprout Social has guided to $332-$333 million in revenue, representing 31% y/y growth. Note as well that the company’s Q2 revenue guidance of $78.6-$78.7 million (+28% y/y) came in below Wall Street’s $79.9 million expectations (+30% y/y).

Sprout Social outlook (Sprout Social Q1 earnings release)

This puts Sprout Social’s valuation at 6.3x EV/FY23 revenue. In light of the company’s recent deceleration as well as the contraction of multiples across the software industry, I’m not willing to take this bet – I’d be more comfortable investing in Sprout Social if it reaches below 5x forward revenue, representing a $33 price target and ~20% downside from current levels.

The bottom line here: continue to watch this stock, but don’t rush to buy in now.

Q1 download

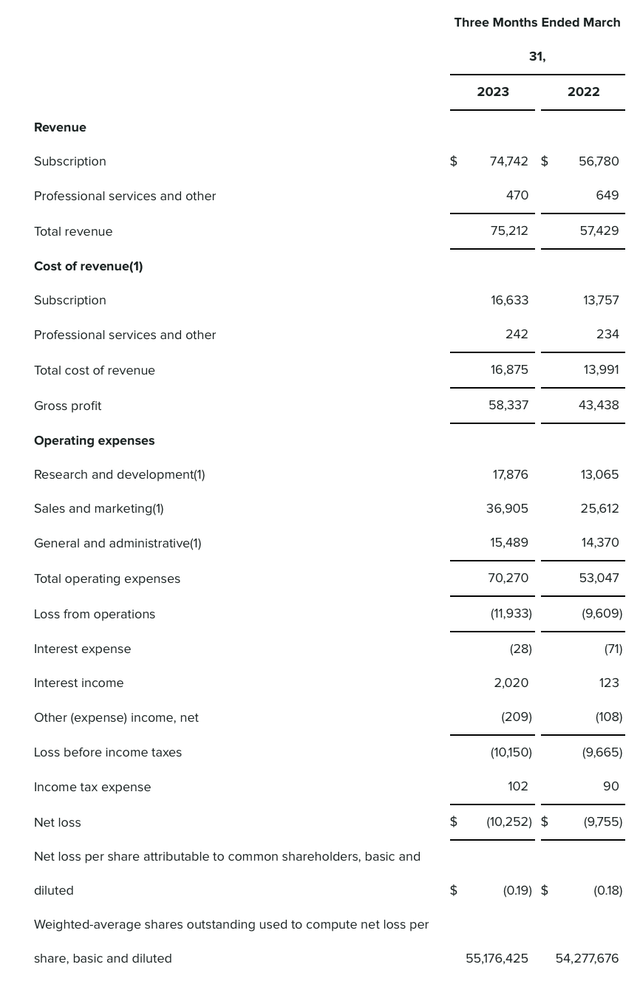

Let’s now go through Sprout Social’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Sprout Social Q1 results (Sprout Social Q1 earnings release)

Sprout Social’s revenue in Q1 grew 31% y/y to $75.2 million, in-line with Wall Street’s expectations of $75.1 million. Note that revenue decelerated from 33% y/y growth in Q4, which in turn decelerated from 37% y/y growth in Q3.

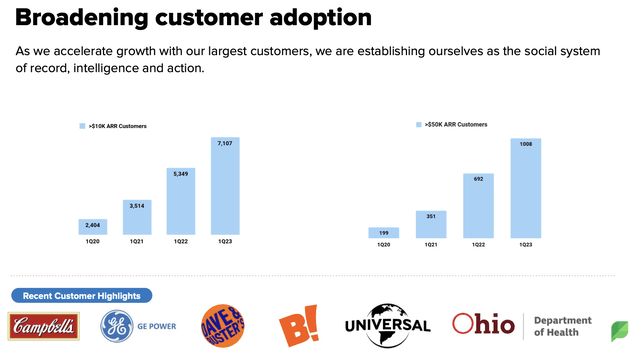

The company has made a strategic decision to shift away from chasing a lot of smaller clients, and focus instead of large customer adoption. Total customer counts were roughly flat y/y (+3% y/y), while the number of customers generating >$50k in ARR per year grew 46% y/y to ~1k, as shown in the chart below:

Sprout Social customer growth (Sprout Social Q1 earnings release)

Per CEO Justyn Howard’s remarks on this strategic shift on the Q1 earnings call:

As I mentioned, our less than $2,000 customer cohort as a proxy for noncore customers is now less than 5% of total ARR. Until this quarter, these customers have been allocated a meaningful investment in sales and customer success resources, specifically accounting for more than 20% of our total customer success headcount in spite of NDR just barely over 100%, significantly lower than the rest of our customer base. This was an investment with negative ROI, and we believe removing this anchor and shifting resources will position our company for fundamental growth and margin acceleration.

We’ve also made great progress on our top of funnel demand since making our pricing changes last November. We anticipated and initially experienced the decline in our top of funnel trial volume while we deemphasized high-volume, low-value leads. However, through the marketing team’s exceptional work on content, messaging and SEO, we’ve seen our overall trial volume move to pre-price change volume levels beginning in March, with further acceleration in April. At far higher price points, we believe this underscores the size of our market and a far greater near-term revenue opportunity.”

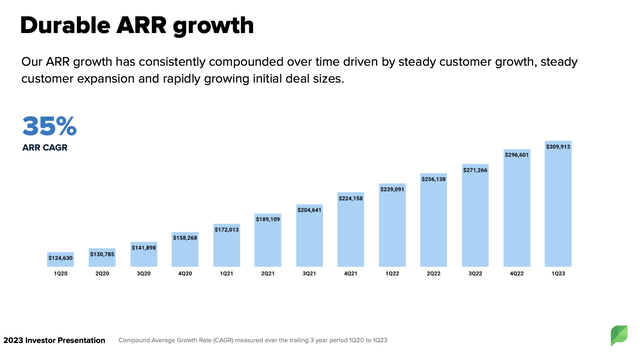

I’m not entirely bearish on Sprout Social, and I think this decision is a prudent one to conserve sales resources and chase more meaningful ARR growth. And on that point, the company still shows impressive ARR trends, adding ~$13 million of net-new ARR in the quarter to land at $310 million in ARR, up 30% y/y.

Sprout Social ARR growth (Sprout Social Q1 earnings release)

We also note that Sprout Social’s pro forma operating margins improved by four points year-over-year to 2%, up from -2% in the year-ago Q1. Free cash flow also jumped 55% y/y to $7.9 million, helped both by a declining services revenue mix (ie, a higher subscription software revenue mix) which boosted gross margins, as well as greater operating leverage from focusing sales efforts on larger customers.

Key takeaways

Sprout Social is seeing some near-term challenges, including right-sizing expectations to a new lower-growth macro environment as well as a still-overvalued share price. However, this stock will make an attractive buy again when it sinks to the low/mid-$30s. Keep this one on the watch list.

Read the full article here