Introduction

After writing a number of (high-yield) retirement-focused articles, it’s time to add two more high-yield stocks. In light of my macroeconomic view and issues when it comes to retirement funding, I’m adding two high-yielding stocks in the energy space before we move to other industries in the weeks ahead.

One dividend stock with a fixed and steadily rising stream of income and one with a variable dividend yield, capable of significantly boosting one’s income when oil prices are elevated. I own one of them myself to protect my portfolio against inflation and boost my average yield.

So, without further ado, let’s dive in!

Income Is Key

The other day, I read an interesting article in the Wall Street Journal with a somewhat blunt title:

Wall Street Journal

It reminded me of a recent report by Fidelity, which has revealed that 52% of Americans are not adequately saving for retirement. This has been compounded by the fact that 401(k) accounts saw a 23% loss of value in 2022 (compared to 2021).

55% of people aged between 18 and 35 have put their retirement planning and saving on hold.

But wait, there’s more bad news.

According to the 2022 Schroders US Retirement Survey, only 22% of those nearing retirement age feel they have saved enough money to sustain their desired standard of living, which is a decline from 26% the previous year. This means that just one in five individuals are ready for retirement. The majority of people believe they have not saved enough, and they are especially concerned, given the possibility of a deteriorating economic situation.

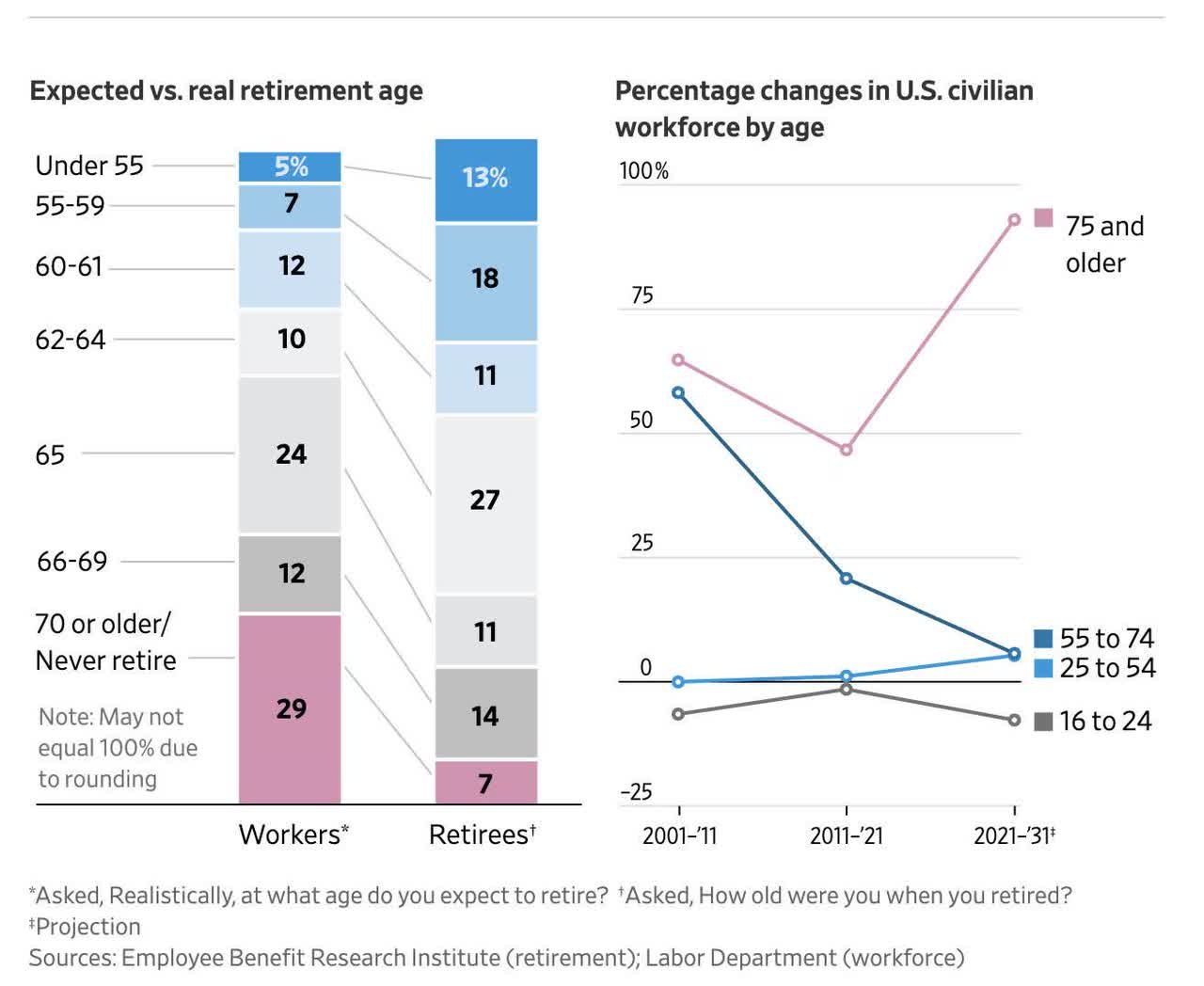

To go back to the WSJ article, it’s absolutely stunning to see the difference between the expected retirement age of people still working and the actual retirement age of current retirees.

- 31% of people retired before reaching the age of 60.

- Only 7% retired after 70 or do not expect to retire ever.

- Roughly 12% of workers expect to retire below the age of 60.

- Almost 3 in 10 workers expect to retire after 70 or not at all.

Wall Street Journal

While it needs to be seen what the actual numbers look like ten years from now, we’re dealing with a very bad trend, amplified by high inflation, unfavorable demographics, and the fact that this economy is a lot tougher on people than the last century, which was much more favorable for people investing for their retirement.

With all of this in mind, in this article, I present two picks with juicy dividends.

About The Picks – Why Energy?

Both picks are energy picks. However, only one of them is directly tied to the price of oil and gas, as it’s an upstream driller with a fat variable dividend. The other has a much more conservative business model, providing consistently rising dividends.

I have two reasons to go with energy stocks.

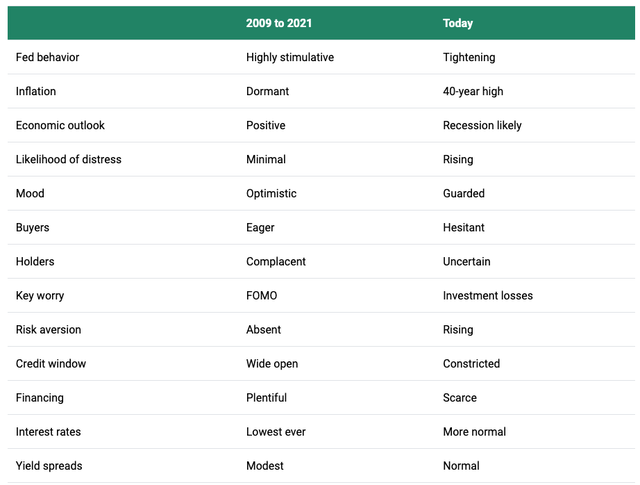

- I believe in a prolonged period of above-average inflation. In December, I wrote an article titled: Buckle Up, It’s a New Investment Era! In that article, I explained that the market had entered a new investment era of higher rates, higher inflation, and secular headwinds. I used a table from investment legend Howard Marks, which can be seen below. In such an environment, stocks are likely to remain stuck in a volatile and prolonged sideways trend, which shifts the focus from high potential capital gains to income – especially for people close to or in retirement.

Oaktree Capital Management

- Reason two is related to reason one. I am a long-term energy bull. Why I believe that energy will remain subject to temporary demand fears (like the current decline in oil prices), I believe it is crucial to own energy stocks. In April, I wrote an article making the case for energy investments purely for the sake of being protected. In that article (and countless related energy articles), I made the case that energy supply growth is heavily constrained while demand isn’t weakening as much as expected – especially not before 2050.

Now, let’s finally discuss the stocks.

Enterprise Products Partners (EPD) – 7.7% Yield

Interestingly enough, I got a number of requests to incorporate EPD in a future article. This is the perfect opportunity to honor these requests, as I think that EPD is a fantastic high-yield play without direct exposure to energy prices.

However, please keep in mind that EPD is a limited partnership. This company issues a k-1 form, which means it can have an impact on your tax situation, while some foreign investors may not be able to invest at all.

That said, most people seem to be fine with K-1 forms, which is what I get from various comment sections and discussions with investors.

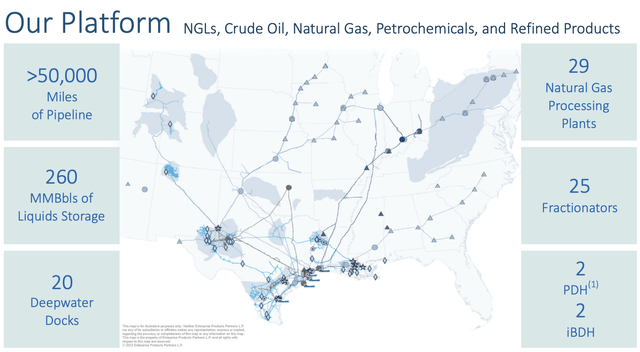

Anyway, this limited partnership owns a massive network of pipelines and related infrastructure in North America. This includes more than 50,000 miles of pipeline, 29 natural gas processing plants, and 20 deepwater docks.

Enterprise Products Partners

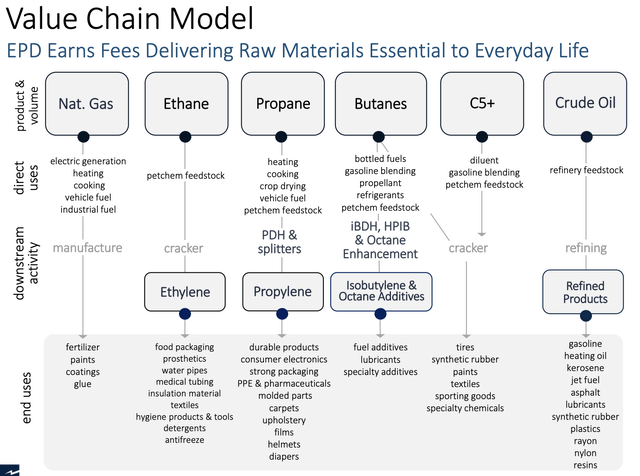

The reason why EPD isn’t dependent on the price of commodities is its industry role as a midstream company. It transports fluids and gases from producers to customers. Commodity pricing risks mainly apply to producers of oil and gas. The biggest risk to EPD is energy demand risk, which could lower volumes and long-term subdued prices that could force producers to lower output, which also hurts throughput.

Enterprise Products Partners

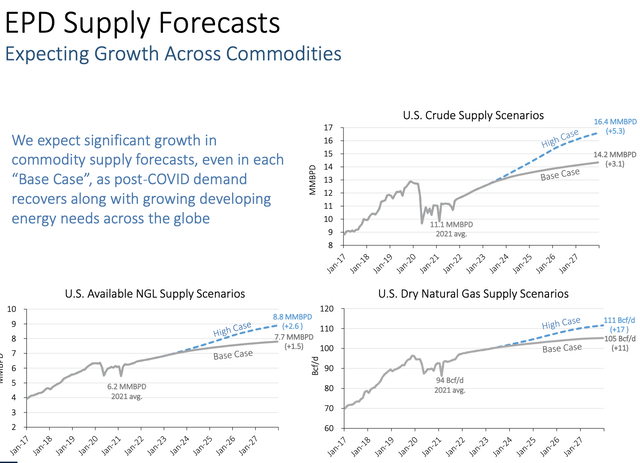

Hence, it’s interesting that EPD shares my outlook when it comes to consistent demand growth. It also sees a higher supply of fossil fuels in the United States, albeit at a slower growth rate. This, too, confirms my thesis.

Enterprise Products Partners

On top of that, US liquid natural gas exports are expected to rise by 21.2 billion cubic feet per day until 2030. The total current export capacity is 13 billion cubic feet per day.

It also helps that EPD is extremely strong. It has a BBB+ credit rating, which is one step below A, 24 consecutive years of distribution increases (it’s almost a dividend aristocrat), and an average return on invested capital of 12% over the past ten years.

Despite higher rates, the company’s weighted average cost of debt is just 4.6%. Its leverage ratio is 2.9x EBITDA, with a long-term target of 2.75 to 3.25x EBITDA.

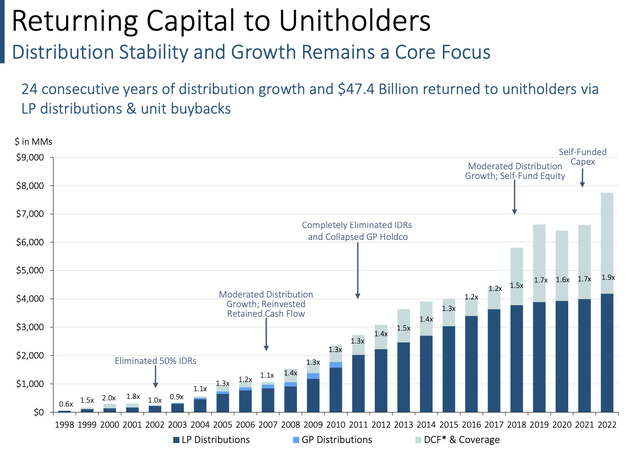

Hence, this is what the company’s dividend history looks like:

Enterprise Products Partners

- The company didn’t cut its distributions (dividend) during the Great Financial Crisis, the 2015 commodity crash, or the pandemic of 2020.

- Since the early 2000s, the company has had fully-covered dividends. As of 2021, the company is completely self-funded.

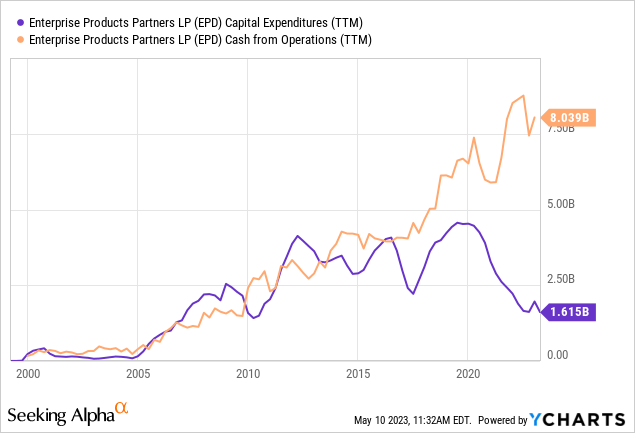

The chart below shows that CapEx requirements have come down while operating cash flow has improved.

According to the company (emphasis added):

For the 12 months ending March 31, 2023, Enterprise paid out approximately $4.2 billion of distributions to limited partners. In addition, we also repurchased $267 million of common units off the open market. As a result, our payout ratio of adjusted cash flow from operations was 55% for this period and our payout ratio of adjusted free cash flow was 75% for this 12-month period.

The current yield is 7.7%. The average annual dividend growth rate of the past five years was 2.6%. The most recent hike was announced on January 5, when the company hiked by 3.2%.

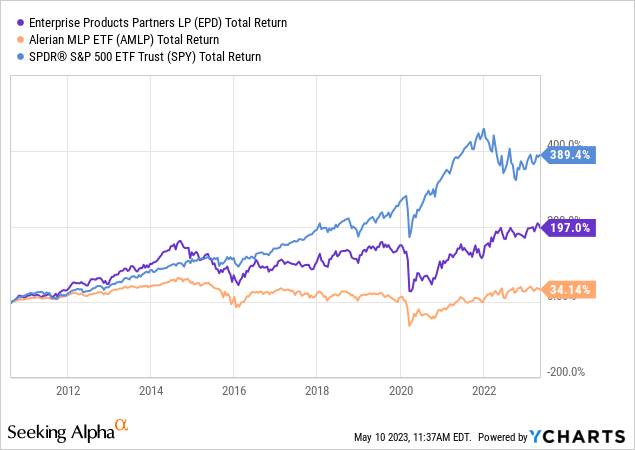

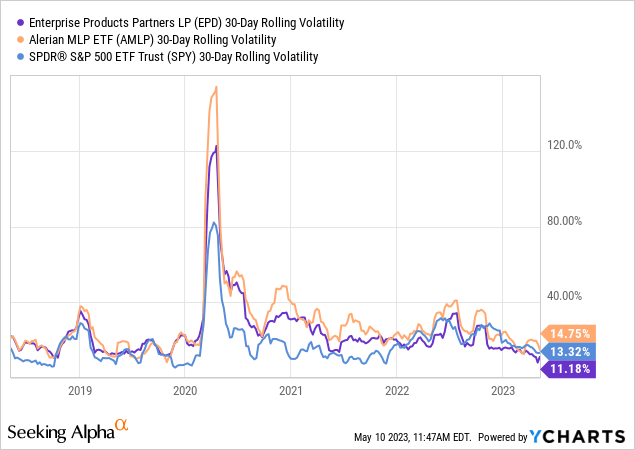

Furthermore, thanks to its qualities, the company has returned 200% since the Great Financial Crisis. The Alerian MLP ETF (AMLP) has returned just 34%, which includes dividends. While EPD was unable to keep up with the S&P 500, investors are getting one of the best MLPs on the market capable of delivering steadily growing above-average income.

Furthermore, EPD is less volatile than the AMLP ETF. It is even less volatile than the market since the second half of 2022.

The only reason why I do not own EPD is that I am not yet ready to shift my portfolio toward a high-yield portfolio.

However, I do own some high-yield energy picks for the reasons mentioned earlier in this article. My biggest energy bet is the stock we’re going to discuss now.

Pioneer Natural Resources (PXD) – 6.4% Yield

Whereas EPD comes with a high regular dividend, PXD is different. Pioneer Natural Resources is what I consider to be the best onshore driller in North America, which is why I finally put it into my dividend growth portfolio. I did this with the proceeds from selling Exxon Mobil (XOM), which I explained in this article.

To show you how much faith I have in this pick, it is now my third-largest investment accounting for 5.4% of my portfolio.

Pioneer Natural Resources is one of America’s largest onshore oil and gas producers. Founded in 1997, the company has a $49 billion market cap.

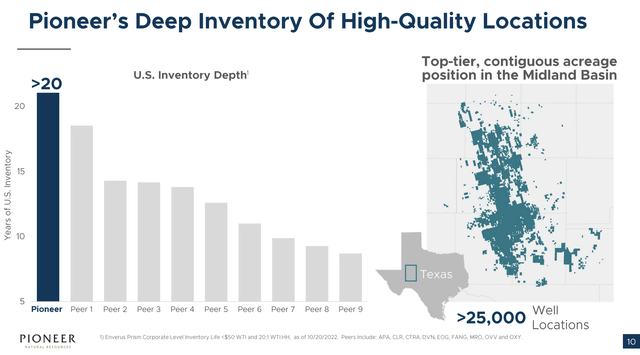

Its operations are in the Midland, a highly efficient area in the already highly efficient Permian basin.

In that area, the company has more than 20 years’ worth of high-quality inventory, more than any of its peers.

Pioneer Natural Resources

This year, the company plans to deliver oil production ranging from 357,000 to 372,000 barrels of oil per day and total production ranging from 670,000 to 700,000 barrels of oil equivalent per day.

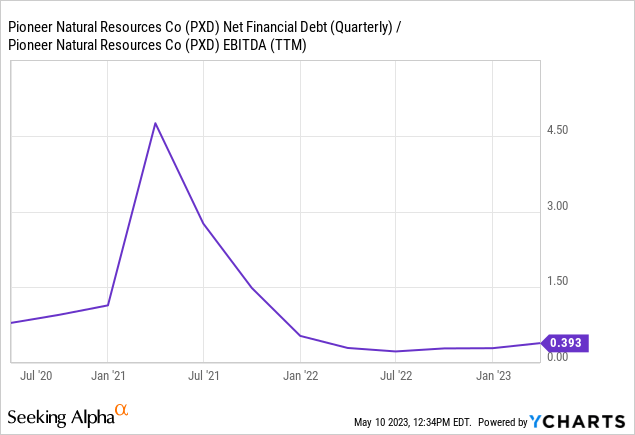

The company is doing this extremely efficiently. The company is breakeven at $39 WTI, which is among the lowest in the industry. The company also has a healthy balance sheet with a net debt ratio of less than 0.5x EBITDA.

This allows the company to distribute most of its cash to shareholders.

Under its refined capital framework, 75% of the company’s quarterly free cash flow, starting with the current (2Q23) quarter, will be returned to shareholders through a combination of base dividends, variable dividends, and opportunistic share repurchases.

A strong and growing base dividend remains the highest return of capital priority. In total, 75% of the quarterly cash flow will be directed towards capital returns, while the remaining 25% will be used to increase financial flexibility and further strengthen the balance sheet.

To further strengthen the foundation of its capital return strategy, Pioneer Natural Resources increased its quarterly base dividend by 14% to $1.25 per share or $5 per share on an annualized basis. This translates to a base dividend yield of 2.4%.

This dividend increase is incorporated into this quarter’s base plus variable dividend that will be paid in June and reflects the sixth consecutive year of base dividend increases.

That said, the base dividend isn’t that attractive. What matters is the company’s special dividend. Based on its June dividend, the yield is north of 6%, which is based on oil prices in the $70s range.

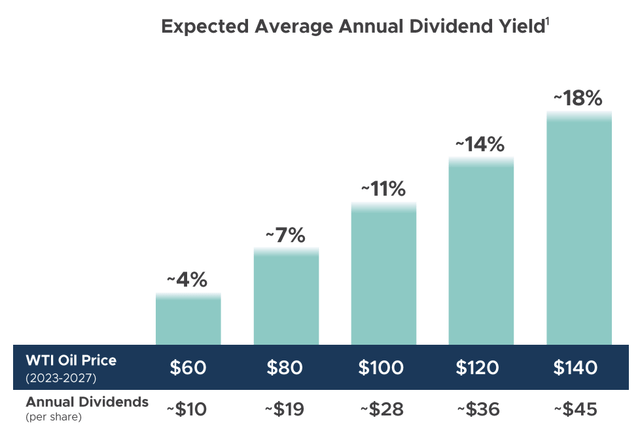

In a situation of $100 WTI, which I expect to happen, the company is in a good spot to boost its annual dividend to $28. That would indicate a 14% yield based on current prices.

Pioneer Natural Resources

While I expect oil prices to remain in triple-digit dollar territory on a prolonged basis, I’m fine with the current dividend. It’s an industry-leading dividend and a great addition to my portfolio to juice up the average yield.

Furthermore, PXD engages in buybacks.

Pioneer has repurchased $2.1 billion in equity since the beginning of 2022, reducing shares outstanding by approximately 4%, which has benefited long-term shareholder returns and per-share metrics.

In 1Q23, the Board of Directors approved a new $4 billion share repurchase authorization, providing additional capacity to return capital through opportunistic share repurchases.

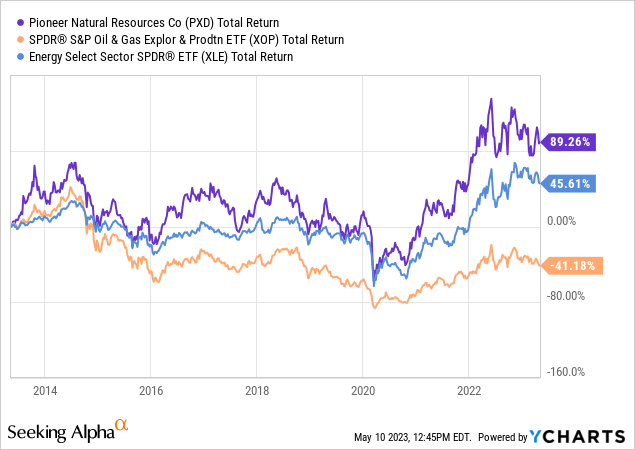

Also, PXD has consistently outperformed its peers.

While PXD is much more volatile than EPD and prone to steep sell-offs during recessions, I believe that it’s a great way to buy an above-average yield with strong inflation protection.

However, retired investors should not go overweight in PXD due to the cyclical risks and be aware of the volatility of the company’s special dividend. While this company will print money the moment oil moves higher again, it will have to cut its special dividend if oil continues to fall.

Personally, I’m fine with that, as I treat PXD as an income vehicle that will still deliver satisfying dividends at subdued oil prices.

Hence, when it comes to oil, I think PXD is the single best way to make money on higher prices/inflation.

Takeaway

In this article, we discussed two high-yielding stocks for retirees and everyone looking to enhance portfolio income. In light of the high risks of prolonged above-average inflation and elevated energy prices, I believe it is key to own energy stocks.

EPD is a stock that comes with a very juicy and safe dividend. The company has a fantastic dividend track record, a stellar wide-moat business model, and a long-term bull case consisting of rising energy supply and demand.

PXD is different. This oil driller is my favorite upstream company. The company has low breakeven prices, high reserves in America’s best basin, a healthy balance sheet, and a policy of distributing most of its free cash flow to shareholders. Even if I’m wrong and oil remains at current prices, investors benefit from a juicy >6% yield. If my oil bull case is right, we could be looking at yields close to 15% (or higher).

While these stocks won’t allow people to retire overnight, I believe incorporating these stocks can help investors get closer to their goals, especially at a time when most people are so far away from financial independence and likely to encounter more inflation and stock market headwinds.

Read the full article here