BBB Foods Inc.’s stock was up 9% at the closing bell in its trading debut on Friday, as Wall Street gobbled up shares of the rapidly growing Mexican supermarket chain.

BBB Foods

TBBB,

ended its first day of trading on the NYSE at $19.05 a share for a comfortable gain over the initial-public-offering price of $17.50 a share. The stock opened at $19.50 a share and rose as high as $21 a share during the session.

In a sign of keen interest ahead of its debut, the BBB Foods IPO priced at the top of its estimated range of $16.50 to $17.50 a share.

With 33.66 million shares, the IPO generated $589 million in proceeds as one of the larger deals to debut so far in 2024.

Global banking giants JPMorgan, Morgan Stanley, BofA Securities, ScotiaBank and UBS were listed as underwriters of the IPO.

BBB Foods is finishing out a busy week for IPOs and is at least the second major deal to have boosted its pricing level in a sign of investor appetite for stocks, with the S&P 500

SPX

reaches closing about the 5,000 mark Friday for the first time ever.

Kyvernia Therapeutics Inc.

KYTX,

fell 0.7% to $29.80 on Friday in its second day of trading. On Thursday, the IPO priced at $22 a share, above its increased price range of $20 to $21 a share.

Ahead of its debut, the drug developer upped the size of the IPO from 11.1 million shares to 14.5 million shares and hiked its estimated price range from an earlier level of $17 to $19 a share, for IPO proceeds of $319 million.

Some recent IPOs have not fared as well.

Metagenomi Inc.

MGX,

priced 6.25 million shares at $15 a share for proceeds of about $94 million. That stock debuted Friday at $10.25 a share on its first trade and later changed hands at $10.86, about 28% below its IPO price.

On Thursday, luxury ski and clothing brand Perfect Moment Ltd.

PMNT,

fell in its stock-market debut.

Also this week, Fortegra Group withdrew plans to raise about $297 million in its IPO, citing “prevailing market conditions.”

One week ago, Fractyl Health Inc.

GUTS,

priced 7.33 million shares at $15 a share for proceeds of $110 million. The stock fell below its offering price in its first day of trading. On Friday, the stock fell about 4% to $10 a share.

Also last week, Alto Neuroscience Inc.

ANRO,

priced 8.4 million shares at $16 each for proceeds of $129 million. The stock started trading on Feb. 2 and was down 12% to $16.69 on Friday.

BBB Foods books rapid revenue growth

BBB Foods was offering shareholders a stake in a business with a compound annual growth rate of 34.4% between 2020 and 2022.

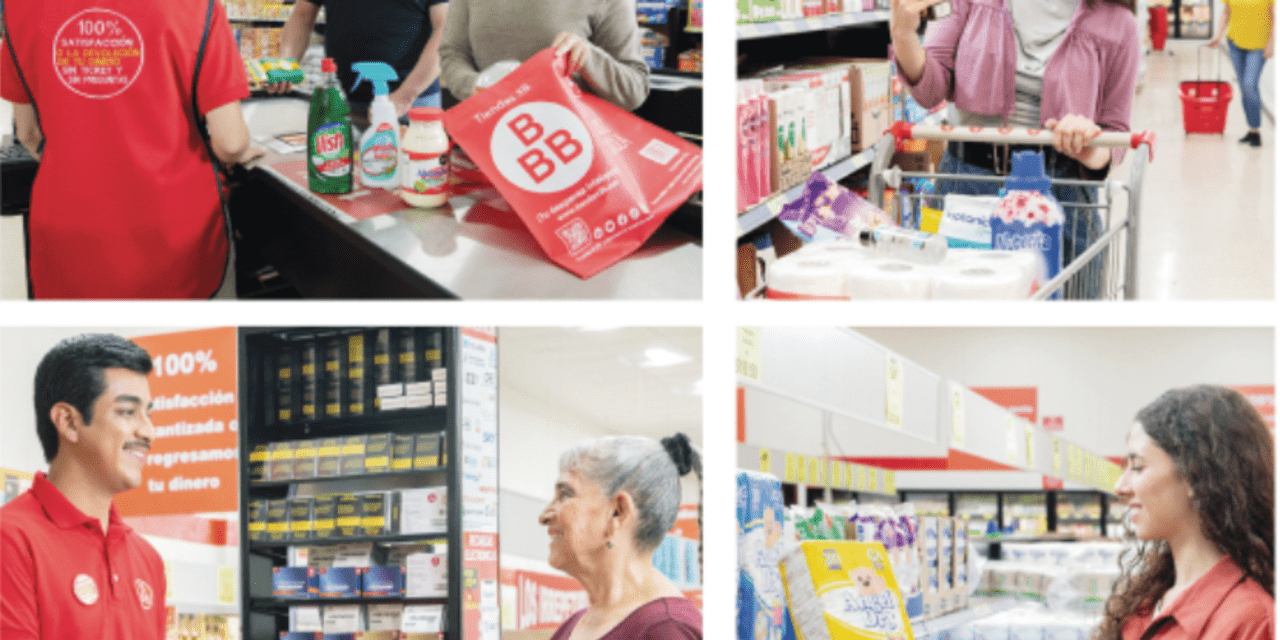

The BBB in the name stands for Bueno, Bonito y Barato, which translates to good, nice and affordable.

The company currently operates about 2,300 stores but sees market potential in Mexico for up to 12,000 stores.

“We believe that there is a large whitespace opportunity for Tiendas 3B,” the company said. “This opportunity will be driven by market expansion as a result of favorable demographic trends, the under-penetration of hard discount stores in the Mexican grocery market, and hard discount’s growing appeal with the Mexican consumers.”

In the nine months that ended Sept. 30, BBB Foods reported a loss of $11.87 million on revenue of $1.8 billion, compared with a year-earlier loss of $32.1 million and revenue of $1.85 billion.

On Thursday, BBB Foods boosted its estimated price range from its earlier level of $14.50 to $16.50 a share and increased the size of the offering to 33.66 million shares from 28.05 million shares.

The additional 5.61 million shares are all coming from existing BBB Foods shareholders, including Quilvest Capital Partners, with no proceeds earmarked for the company itself.

Read on:

Amer Sports stock ends its first day of trading with a 3% gain over its discounted IPO price

IPO market continues its revival with investors looking to Amer Sports, BrightSpring — and Reddit

Read the full article here