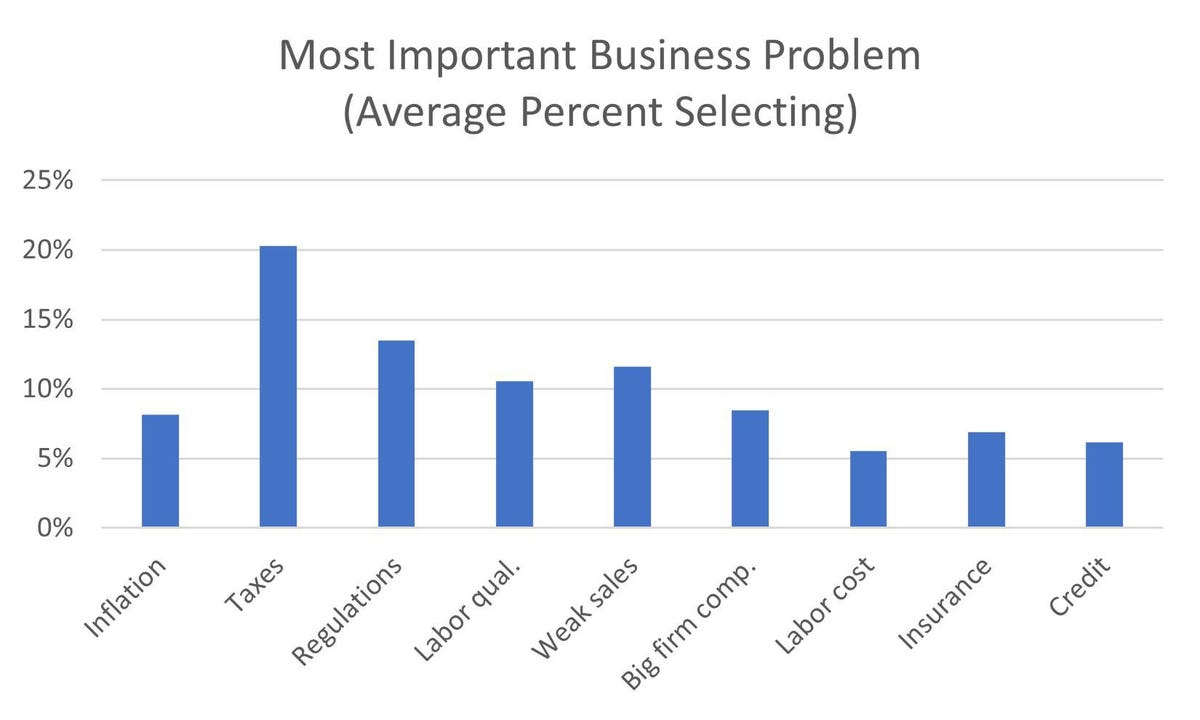

Taxes are very important economic signals for small business owners. The government thinks that small business is “under-taxed.” I guess they think each of the tens of millions of small firms has a tax specialist and a lawyer on staff to help them navigate the impossibly complex federal tax code. Politicians supporting higher taxes on incomes and now, on wealth (your estate), repeatedly say “you don’t pay your fair share”[1] but they never define “fair,” they just want more. Because earnings are the major source of financing for small business expansion, taxes on profits, property, sales, labor, etc. are the most important policy issues. Owners are asked every month to identify their most important business problem from a list of ten choices. Since 1975, taxes have received more #1 votes than any other issue (Chart 1). Second place went to regulations, a form of direct taxation, third to weak sales, and fourth to the quality of labor.

Although inflation is the top business problem cited for the last several years, it was not always the top problem. Two “bookend” periods of high inflation frame a long period of time when inflation was not such a bother: 1975-1982 and 2020-2023. Taxes have always been a major concern, reaching their lows in concern in the four years leading up to 2021, but often leading the polls on votes for the top business problem. The cost of regulation, compliance and continuing operating costs, was the second place “winner,” just another tax. Instead of taxing the firm to then implement a change, the government forces the firm to spend its own funds and bear the cost. Third place goes to “weak sales,” responses rising sharply when recessions occur. Recessions, such as 2008-2009 might be blamed on government regulations. The government’s regulations encouraged irresponsible lending, causing bank failures, consumer losses, and triggering a recession. Fourth place was “the availability of qualified labor.” Votes for this concern rise when the economy does well and labor markets get tight. The last surge of votes came during the 2016-2020 period, but continued through the recession as Covid reduced the supply of labor. “Competition from large firms” surged in the 1984-1991 period but has yielded to the other top concerns since then.

Raising the cost of anything reduces the amount taken, a fundamental economic principle. Imposing a tax on some item or activity will reduce its attractiveness. Taxing income discourages work and encourages evasion. Taxing wealth discourages its accumulation. Taxes are of course used to produce other “services,” including income redistribution, the value of which cannot be determined because government services are not market determined. A market would not give higher risk buyers a mortgage discount and charge low risk borrowers a higher rate. But the government is imposing such a tax. Ultimately these issues are resolved at the ballot box and by serious economic dislocations that force a regulatory correction.

[1] High income taxpayers pay the highest tax rates, according to the IRS. The average income tax rate in 2020 was 13.6 percent. The top 5 percent of taxpayers paid a 22.4 percent average rate while the top 1 percent of taxpayers paid a 26.0 percent average rate—more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

Read the full article here