Introduction

Houston-based APA Corporation (NASDAQ:APA) released its first quarter 2023 results on May 3, 2023.

Note: I have followed APA quarterly since 2017. This new article is a quarterly update of my article published on March 6, 2023.

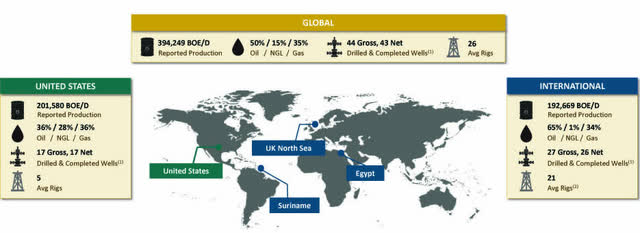

Apache Corp. owns energy-producing assets in the U.S., the North Sea, and Egypt. Also, the company is involved with two blocks in Suriname which are not producing now.

APA Production Snapshot (APA Presentation)

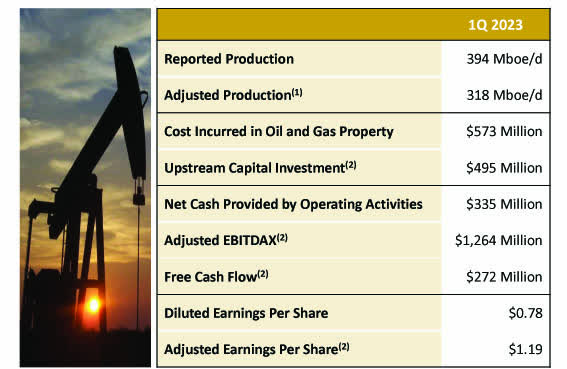

1 – 1Q23 results snapshot

During the first quarter of 2023, APA reported a net income attributable to common stock of $242 million, or $0.78 per diluted share. When adjusted for certain items that impact the comparability of results, APA’s first-quarter earnings were $1.19 on a diluted share basis.

The net cash from operating activities was $335 million, and adjusted EBITDAX was $1,264 million in 1Q23. Total Production was 394,249 Boep/d in 1Q23.

APA 1Q23 Snapshot (APA Presentation)

CEO John Christmann said in the conference call:

first quarter results, which are characterized by strong operational performance and good cost control. APA met or exceeded production guidance in each of our 3 regions. Total adjusted production was 4,000 BOEs per day, above the top end of our guidance range. Adjusted oil production also exceeded expectations, led by performance in the Permian and the North Sea. Capital investment during the period was slightly below guidance, and our average operating drilling rig count remained steady in the quarter with 17 in Egypt, 5 in the Permian Basin and 1 semisubmersible in the North Sea.

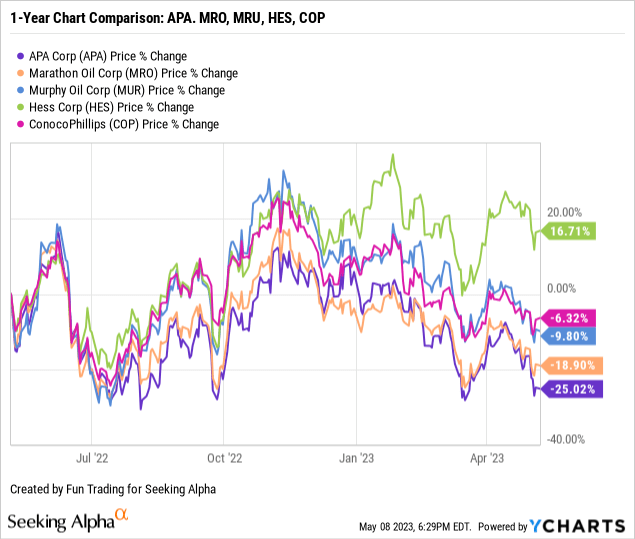

2 – Stock performance

Let’s compare APA to a few other E&P oil and gas companies (e.g., Murphy Oil (MUR), Hess Corp. (HES), ConocoPhillips (COP), Marathon Oil (MRO), etc.).

We can see that APA continues to underperform the group and is down 25% on a one-year basis.

APA Corporation is a decent E&P company that I consider suitable for a long-term investment in the oil industry. However, the company is definitely struggling in 2023. While owning APA long-term makes sense, especially after the stock retraced significantly, it is also prudent to trade LIFO APA for about 30%-40% of your position.

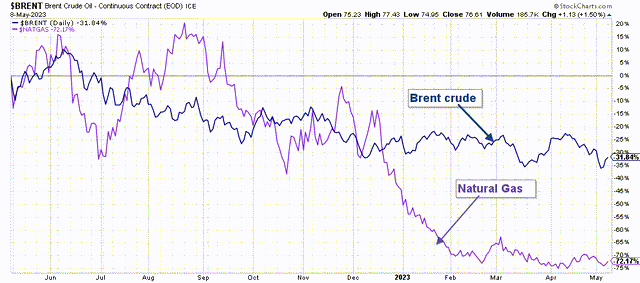

Oil and predominantly natural gas prices have dropped significantly, and fundamentals are weak, with a potential recession in H2 2023.

APA 1-Year Chart Brent oil and NG (Fun Trading StockCharts)

APA Corporation – Balance sheet and production history for Q1’23: the raw numbers

| APA | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Revenues from oil and gas in $ billion | 2.669 | 3.047 | 2.887 | 2.472 | 2.008 |

| Total Revenues and others in $ Billion | 3.828 | 3.052 | 2.872 | 2.380 | 2.030 |

| Net Income in $ Billion | 1.813 | 0.926 | 0.422 | 0.443 | 0.242 |

| EBITDA $ Billion | 2.68 | 1.81 | 1.56 | 1.23 | 1.22 |

| EPS diluted in $/share | 5.43 | 2.71 | 1.28 | 1.38 | 0.78 |

| Cash from Operating Activities in $ Million | 891 | 1,535 | 1,104 | 1,413 | 335 |

| CapEx in $ Million | 379 | 388 | 994 | 637 | 549 |

| Free Cash Flow in $ Million | 512 | 1,147 | 110 | 776 | -214 |

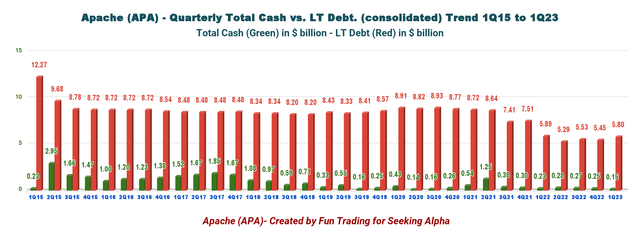

| Total cash $ Billion | 0.23 | 0.28 | 0.27 | 0.25 | 0.15 |

| Total LT Debt in $ Billion | 5.89 | 5.29 | 5.53 | 5.45 | 5.80 |

| Dividend per share in $ | 0.125 | 0.125 | 0.25 | 0.25 | 0.25 |

| Shares outstanding (diluted) in Million | 347 | 342 | 330 | 312 | 312 |

| Oil Production | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

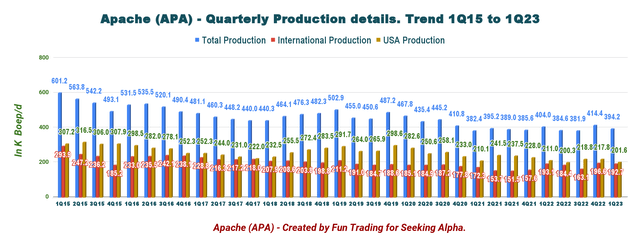

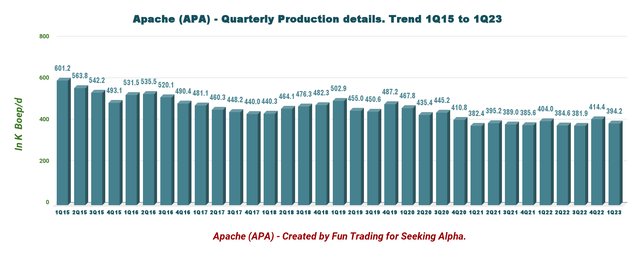

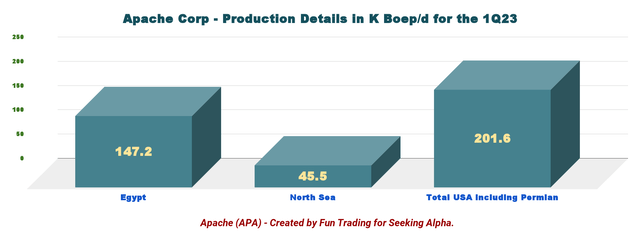

| Total Oil Equivalent in K Boepd | 404.0 | 384.6 | 381.9 | 414.4 | 394.2 |

| International | 193.1 | 184.4 | 163.1 | 196.6 | 192.7 |

| USA | 211.0 | 200.3 | 218.8 | 217.8 | 201.6 |

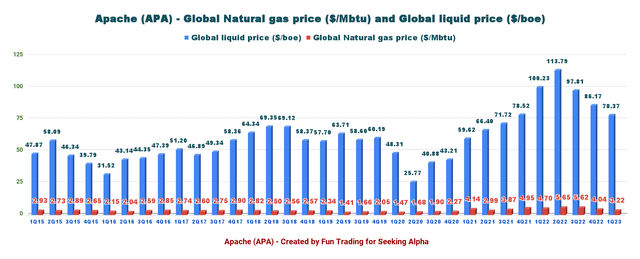

| Global liquid price ($/Boe) | 100.23 | 113.79 | 97.81 | 86.17 | 78.37 |

| Global Natural gas price ($/MMBtu) | 4.70 | 5.65 | 5.62 | 4.04 | 3.22 |

Source: Company filing.

Analysis: Revenues, Earnings Details, Free Cash Flow, And Oil Production

1 – Revenues and others were $2,030 million in 1Q23

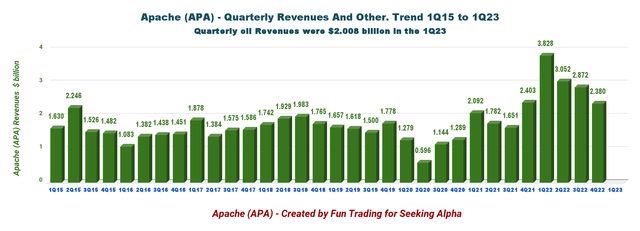

APA Quarterly Revenue History (Fun Trading)

1Q23 total revenues and others were $2.03 billion (with oil revenues of $2.01 billion), down from $3.828 billion the same quarter a year ago.

The global liquid price was $78.37 in 1Q23 compared to $86.17 in 4Q22, as shown in the chart below. Natural Gas was $3.22/Mcf, down from $4.04 the preceding quarter, as shown below:

APA Global Liquid price and NG price History (Fun Trading)

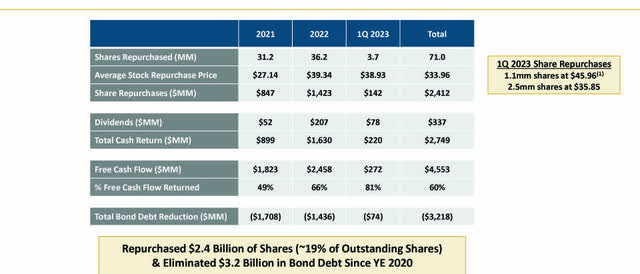

The company kept the dividend this quarter at $0.25 per share and bought back 142 million worth of APA common stocks (1.1 million shares at $45.96 and 2.5 million at $35.85).

Furthermore, APA spent $74 million in total debt reduction in 1Q23.

APA Dividend and Buyback Snapshot (APA Presentation)

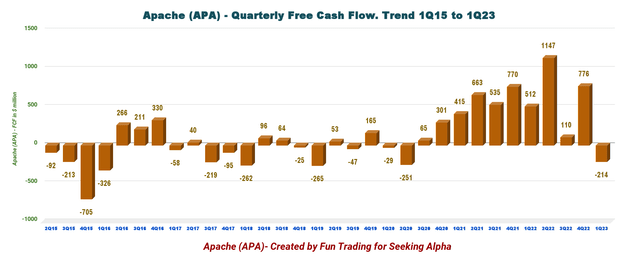

2 – Free cash flow was a loss of $214 million in 1Q23

APA Quarterly Free Cash Flow History (Fun Trading)

Note: The generic free cash flow is the cash from operating activities minus CapEx. The company has a different way of calculating the free cash flow because it is a non-GAAP determination and has indicated $272 million in 1Q23. The company’s calculation adds “change in operating assets and liabilities” and applies a reduced CapEx.

APA’s free cash flow was a loss of $214 million in 1Q23, and the trailing 12-month free cash flow is now $1,818 million.

3 – Net debt increased slightly this quarter at $5.64 billion

APA Quarterly Cash versus Debt History (Fun Trading)

APA does not prioritize its debt profile this quarter, which is not a positive element. The net debt is now going up again.

4 – Oil-equivalent production was 394,249 Boep/d in 1Q23 which comprises 65% liquids (oil + NGL).

4.1 – Production Details

APA Quarterly Production per Region History (Fun Trading) APA Quarterly Oil Equivalent Production History (Fun Trading)

Production in the USA is the most important for the company, with 201,580 Boep/d in 1Q23, or 51.1% of the total output.

APA 1Q23 Production per Region (Fun Trading)

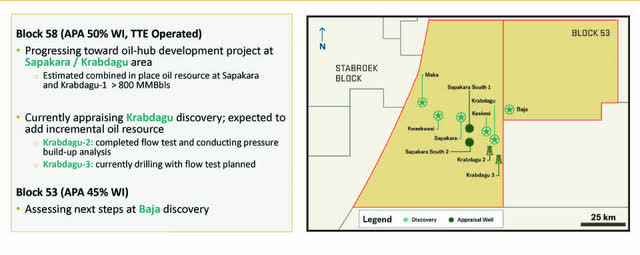

4.2 – Block 58 in Suriname 1Q23 update – Seven exploration discoveries since 2020. Block 53 first discovery.

Block 58 and now block 53 are significant potential long-term assets and could be game changers for the company. These two blocks are very promising and could help APA corporation tremendously. The company is progressing Towards Oil-Hub development on Block 58 Offshore Suriname.

This project justifies a long-term investment in APA. It is similar to what I experienced with Hess Corporation when the company struggled with the cost of its Guyana project a few years back. However, with patience, this bet will probably pay off.

CEO John Christmann said in the conference call:

We continue to progress toward an oil hub development project with activity in the first half of 2023 focused on appraising Krabdagu. We have completed the flow test on the first appraisal well and are currently in the pressure buildup phase. Results of this well thus far are in line with expectations. The second Krabdagu appraisal well is currently drilling and we’ll provide more information on next steps in the future.

APA Suriname (APA Presentation)

Note: in December 2019, APA (then known as Apache) and TotalEnergies (TTE) formed a joint venture to develop the project off Suriname. Under the Suriname deal, Apache and Total held 50% working interest in Block 58. Also, APA Suriname is the operator of Block 53 (45%) with PETRONAS Carigali Sdn Bhd (30%) and Cepsa (25%).

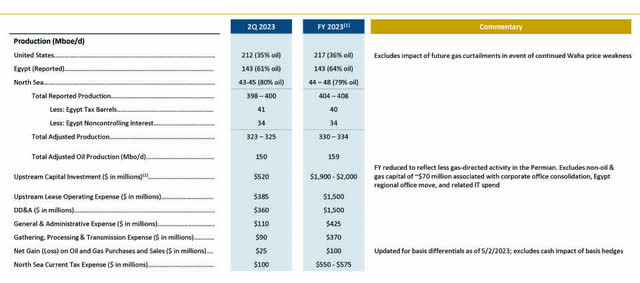

5 – 2023 Guidance

APA Corporation reiterates upstream CapEx of $1.9 to $2.0 billion, down slightly from the preceding quarter.

Total production for 2Q23 will be between 398K to 400K Boep/d or about 2.5% higher than production in 1Q23.

APA is committed to returning at least 60% of free cash flow to shareholders and indicated that it would continue to appraise and explore Block 58 offshore Suriname with its partners.

APA 2023 Guidance (APA Presentation)

Commentary and Technical Analysis

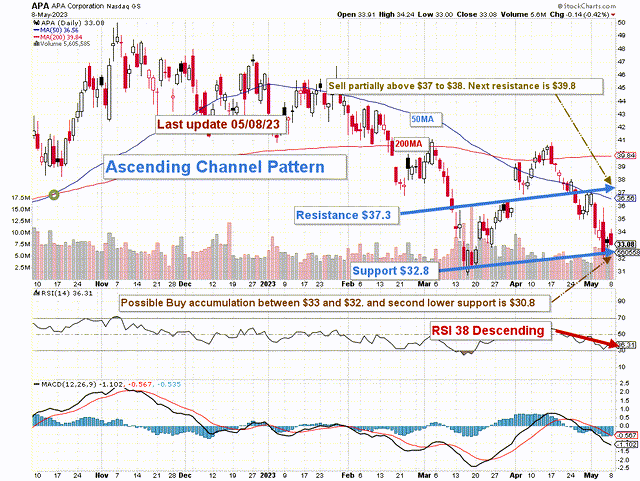

APA TA Chart Short-Term (Fun Trading StockCharts)

Note: The chart has been adjusted for the dividend.

APA forms an ascending channel pattern with resistance at $37.3 and support at $32.8. It is generally considered a bearish pattern. RSI is now 38 and is close to being oversold, which indicates that APA could retest $31-$32 before reaching solid support.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

The short-term strategy is regularly trading LIFO at about 30%-35% of your position. I suggest selling between $37 and $38, with the next higher resistance at $39.8, and waiting for a retracement between $33 and $32, with possible lower support at $30.8.

Watch oil prices like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here